Miami Real Estate Agents: Stop ASKING for DU – it’s illegal and Dangerous

We aim to shed light on this issue and introduce a better approach that guarantees both safety and efficiency for homebuyers.

Understanding the Illegality of Sharing DU Findings

Desktop Underwriter (DU) is an automated system lenders use to assess mortgage loan applications. By processing a wealth of personal and financial information, DU helps lenders make informed, consistent, and fast decisions on loan approvals.

The confidentiality of the data handled by DU is paramount, encompassing credit scores, income details, employment history, and other highly sensitive personal information like Social Security numbers.

The Florida Legal Frameworks Prohibiting the Sharing of DU Findings

In Florida, sharing DU findings with real estate agents is not just frowned upon—it's outright illegal. State laws and federal regulations, such as the Fair Credit Reporting Act (FCRA) and the Gramm-Leach-Bliley Act (GLBA), strictly govern disseminating personal financial information.

Violations of these laws can lead to severe penalties, including hefty fines and legal action. These regulations are in place to protect consumer privacy and ensure the security of financial data.

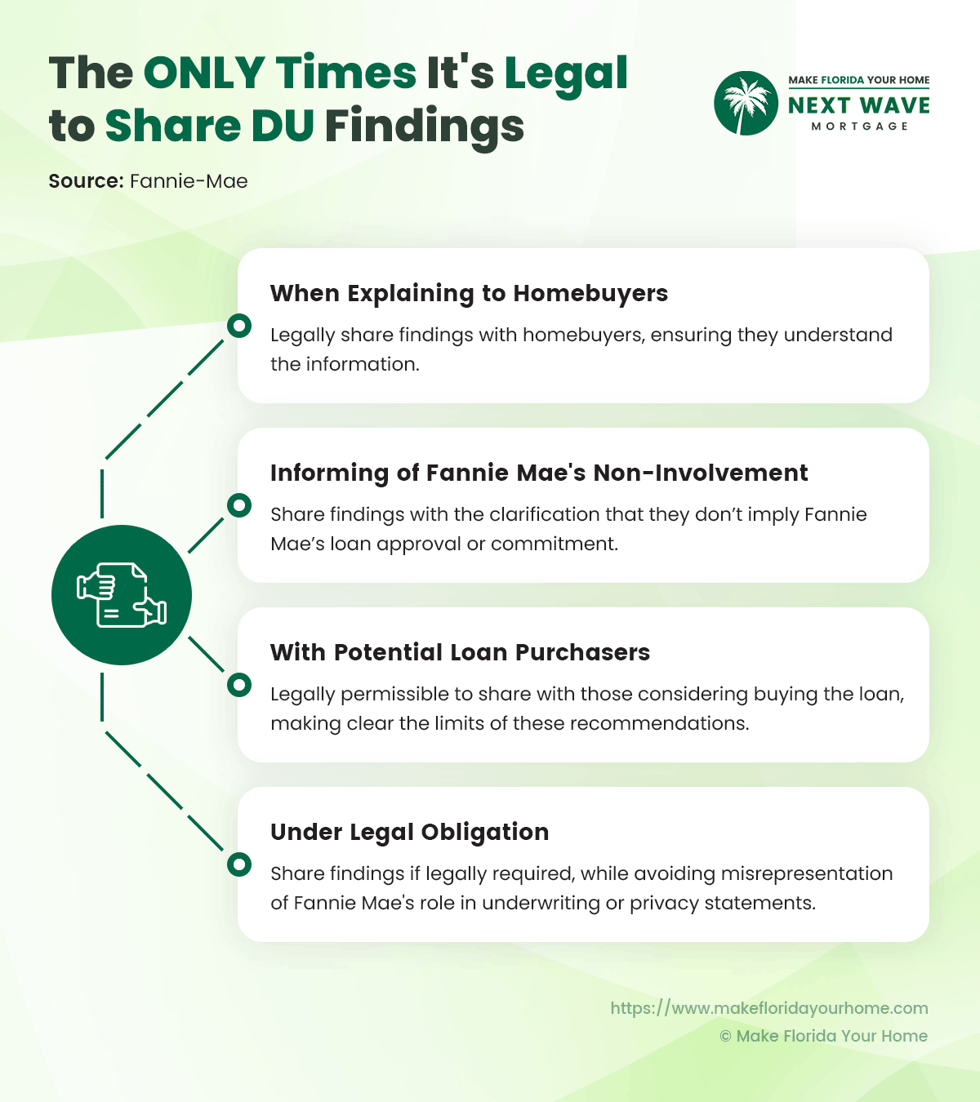

Fannie-Mae is very specific about the situations in which it's legal to share DU findings, and none involve realtors:

Unauthorized Representations; Sharing of Findings and Recommendations

Section clarifies that, other than for the purposes specified, Licensee may not share the DU Findings Report unless required by law.

In addition, Licensees must comply with all requirements related to the access, sharing and use of Loan Case files when using the DU Messages API to retrieve DU findings.

Risks Associated with Unauthorized Access to DU Information

When DU findings fall into unauthorized hands, the repercussions can be severe. Identity theft, financial fraud, and privacy breaches are just some potential risks. Such incidents harm the individuals involved and undermine the trust in the real estate and lending industries.

It's crucial to recognize that safeguarding this information is not just a legal obligation but also a moral imperative to protect clients' privacy and financial well-being.

The Dangers and Implications of Sharing Sensitive DU Information

The information within a DU report is incredibly sensitive. It includes names and addresses, Social Security numbers, income details, and credit histories. Unauthorized access to this data can lead to privacy violations and, in worst-case scenarios, identity theft.

Homebuyers' security of their personal information should be of utmost concern, and they must be aware of the risks involved in sharing their DU findings.

Lenders and real estate agents have a professional duty to handle client information responsibly. Ethical practices are foundational to maintaining trust and integrity in the industry.

By requesting or sharing DU findings, agents and lenders not only break the law but also breach their ethical obligations, potentially damaging their reputation and the trust of their clients.

Such illegal practices can have far-reaching consequences on the Miami real estate market. It can lead to losing confidence among buyers and sellers, negatively impacting the market's integrity.

Ensuring all parties adhere to legal and ethical standards is crucial in maintaining a healthy and trustworthy real estate environment.

MakeFloridaYourHome's Solution for Secure and Efficient Home Buying

At MakeFloridaYourHome, we believe in a different approach. Our solution ensures homebuyers do not need to compromise their privacy or security. With our "Want the Home? We Guarantee it" initiative, we provide a seamless and secure home-buying experience.

Furthermore, we offer a $100 Amazon Gift Card for buyers who achieve full approval, demonstrating our confidence in our efficient approval process.

Protecting Buyer Information and Building Trust

We prioritize the protection of our client’s personal information. By adhering to strict privacy protocols and legal standards, we ensure that sensitive data remains confidential throughout the home buying.

Our commitment to privacy builds trust with our clients, reassuring them that their personal and financial information is safe.

Our promise extends beyond privacy protection. We are so confident in our ability to efficiently process financing that if we cannot close a deal for a financing reason by the contracted date, we will buy the seller's home.

This bold guarantee underscores our commitment to smooth, timely transactions and reflects our dedication to buyers and sellers in the Miami real estate market.

Frequently Asked Questions (FAQ)

For Homebuyers

How can I ensure my financial information remains secure during home-buying?

Always work with reputable lenders and real estate agents who follow legal and ethical guidelines. Be cautious about sharing sensitive information and ask how your data will be used and protected. Make sure any requests for personal financial information are necessary and legally compliant.

What should I do if a real estate agent asks for my DU findings?

Politely refuse and remind the agent that sharing DU findings is illegal in Florida. You can also report this request to the lender or a regulatory authority. Seek advice from legal or financial professionals if you feel your privacy has been compromised.

Can I trust online mortgage approval processes?

Many online mortgage processes are secure and efficient, but verifying the lender's credibility is important. Look for lenders with encrypted data transmission and a clear privacy policy. Companies like MakeFloridaYourHome prioritize client security and can be a reliable choice.

For Real Estate Agents

How can I verify a buyer's financial capability without accessing DU findings?

You can request a pre-approval or mortgage commitment letter from the buyer's lender. These documents confirm the buyer’s financial readiness without disclosing sensitive details.

What are the consequences for real estate agents illegally obtaining DU findings?

Agents who violate privacy laws by obtaining DU findings can face legal action, including fines and license suspension. It can also damage their reputation and trust with clients and within the industry.

Are there any legal alternatives to DU findings for assessing buyer credibility?

You can use alternative documents such as buyer’s credit score range, proof of funds for down payment, and employment verification, which do not involve the same privacy concerns as DU findings. Always ensure that any information request complies with legal standards.

What role should real estate agents play in protecting client data?

Real estate agents should advocate for client privacy and ensure they comply with state and federal regulations. Educate yourself about data privacy laws and implement practices that safeguard client information.

How can I educate my clients about the importance of data privacy in real estate transactions?

Provide clients with resources and information on data privacy. Explain the risks of sharing sensitive information and the legal aspects of real estate transactions. Encourage them to ask questions and seek clarification when unsure about the requested information.

Bottom Line

Respecting legal boundaries and protecting the privacy of homebuyers is not just a regulatory requirement but a cornerstone of ethical real estate practice.

At MakeFloridaYourHome, we uphold these principles while offering innovative solutions to ensure a safe, legal, and efficient home-buying experience in Miami.

We encourage all real estate professionals and homebuyers to adopt responsible practices and consider our services for a secure and reliable real estate transaction. Let's work together to maintain the integrity and trustworthiness of Miami's real estate market.

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by