What is the Florida Empowered DPA Program? A Guide for Homebuyers

Table of Contents

Overview - Florida Empowered DPA Program

The Florida Empowered DPA Program is a new program for homebuyers designed to provide much-needed down payment assistance. More accessible than most programs, it offers valuable support for purchasing a primary residence.

Unlike many other down payment assistance (DPA) programs, the Florida Empowered DPA Program stands out by providing up to 3.5% of the property's value.

This grant is not a loan that needs to be repaid but rather a significant helping hand for homebuyers.

What It Offers

-

Up to 3.5% down payment assistance grant.

-

Covers the entire down payment for an FHA loan.

- Grant is forgiven if you keep the loan for at least six months.

Who Qualifies

-

First-time homebuyers.

-

Military personnel, first responders, educators, medical professionals, government workers.

-

Income earners up to 140% of the area's median income.

- Buyers in underserved census tracts.

Program Requirements

-

Minimum 620 credit score.

-

Primary residence purchase only.

-

Debt-to-income ratio below 48.99%.

-

Approved property types include single-family homes, duplexes, manufactured homes, FHA-approved condos, and PUDs.

- Completion of approved homeownership education course.

How to Apply

- Contact an approved mortgage broker like MakeFloridaYourHome.

Eligibility Requirements for the Florida Empowered DPA Program

Homebuyers must fulfill certain requirements to meet eligibility for the Florida Empowered DPA Program. These prerequisites vary from income limitations to credit score thresholds and specific criteria related to the property.

Must be a first-time homebuyer or not owned a home in the last three years. OR currently or previously a part of the military, first responder, educator, medical professional, or local or federal government worker.

-

Income must be 140% or less of the area's median income.

-

The credit score should be a minimum of 620.

-

The home should be for a primary residence.

-

Debt-to-income ratio not exceeding 48.99%.

-

Property types include single-family homes, duplexes, manufactured homes, FHA-approved condos, and PUDs.

- Completion of an approved homeownership education course is mandatory.

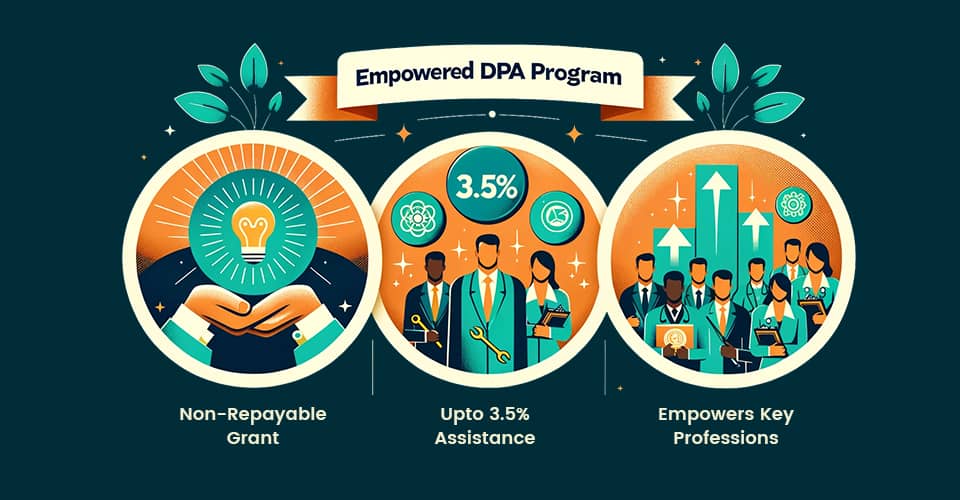

Benefits of the Florida Empowered DPA Program

Thanks to the Empowered DPA program, securing a home has never been easier.

Designed for homebuyers in Florida, this program creates a path to homeownership by reducing economic barriers and making home-buying more affordable.

-

Provides up to 3.5% down payment assistance on the home's purchased price.

-

Offers a non-repayable grant that helps secure an FHA loan effortlessly.

-

Maintains broader requirements, making the program accessible to a wide range of homebuyers.

-

Empowers key professions like military personnel, educators, and first responders with homeownership opportunities.

-

Facilitates homebuyers whose income is 140% or less of the local median income.

- Supports homebuyers intending to purchase property in underserved census tracts.

How Does the Florida Empowered DPA Program Work?

The Florida Empowered DPA Program follows a straightforward process to help homebuyers. Here are the steps:

-

Prequalification - Start by determining if you meet the program's eligibility criteria.

-

Find an approved lender - Work with a lender affiliated with the program to apply for the DPA.

-

Application - Submit your application to the program.

-

Closing - Once approved, complete the necessary steps to close your home.

- Post-purchase support - Receive ongoing support and guidance after purchasing your home.

The Florida Empowered DPA Program simplifies home buying by providing a structured step-by-step approach. This makes it easier for potential homeowners to navigate and secure a property.

What are the Key Features of the Florida Empowered DPA Program?

The Florida Empowered DPA Program helps with down payments, lowers interest rates, offers flexible loan options, and provides education for first-time homebuyers.

It also covers many types of properties. This program does more than the usual mortgage, making it easier for more people to buy homes.

Down Payment Assistance

The Florida Empowered DPA Program helps homebuyers with the initial payment needed to buy a home. It offers up to 3.5% of the home’s purchase price, which can cover the whole down payment if you’re getting an FHA loan.

This makes it easier for many people to buy their first home, as coming up with the down payment is often the hardest part.

Interest Rate Reduction

The program also reduces the interest rate on mortgages, which lowers monthly payments. This reduction can save homebuyers a lot of money over time, making homes more affordable.

It’s especially helpful for those who need to keep their monthly costs down.

Flexible Loan Terms

The Florida Empowered DPA Program offers flexible terms for your mortgage. This means you can adjust your loan to fit your financial situation better.

Whether you need lower monthly payments or a different loan length, this program helps make it possible. It’s designed to make buying a home less stressful and more accessible to different buyers.

First-Time Homebuyer Education

If you’re buying your first home, this program includes an education course that teaches you about the home-buying process.

You’ll learn important things like mortgage basics and how to budget for your new home. This education helps you make informed decisions and prepares you for homeownership.

Property Eligibility

The program isn't just for single-family homes; it also includes duplexes, manufactured homes, FHA-approved condos, and Planned Unit Developments (PUDs).

This diversity allows more buyers to find homes that fit their needs, whether they're looking for an affordable option or a home that can also generate rental income.

Empowered DPA Program FAQs

Here we've answered ten frequently asked questions about the Florida Empowered DPA Program.

What is the Florida Empowered DPA Program?

The Florida Empowered DPA Program is a down payment assistance initiative designed to help first-time homebuyers and eligible professionals such as military personnel and educators secure financing for their primary residences in Florida.

Who qualifies for the Florida Empowered DPA Program?

Eligibility is extended to first-time homebuyers, military personnel, first responders, educators, medical professionals, and government workers.

Applicants must have incomes no more than 140% of their area's median income and be purchasing in designated underserved areas.

What financial assistance does the Florida Empowered DPA Program offer?

The program offers up to 3.5% in down payment assistance as a non-repayable grant, covering the entire down payment for an FHA loan, provided the borrower retains the property for at least six months.

What are the credit requirements to qualify for the program?

Applicants must have a minimum credit score of 620 to qualify for the Florida Empowered DPA Program.

What types of properties are eligible for the program?

Eligible properties include single-family homes, duplexes, manufactured homes, FHA-approved condos, and Planned Unit Developments (PUDs).

Is there an educational requirement for the program?

Yes, applicants are required to complete an approved homeownership education course to qualify for the down payment assistance offered by the Florida Empowered DPA Program.

What is the maximum debt-to-income ratio allowed under the program?

The program allows for a debt-to-income ratio of up to 48.99% for eligible applicants.

How does one apply for the Florida Empowered DPA Program?

Potential applicants should contact an approved mortgage broker, such as MakeFloridaYourHome, to begin the application process for the Florida Empowered DPA Program.

How long must I keep the home to not repay the grant?

The down payment assistance provided by the program is forgivable after six months of maintaining the loan and property.

Can the down payment assistance be combined with other financial aid?

Yes, the down payment assistance from the Florida Empowered DPA Program can typically be combined with other forms of financial aid, though applicants should confirm specific details with their lender.

Contact MakeFloridaYourHome today to see how much money you can save with Empowered DPA. Happy homebuying!

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by