Qualifying for an FHA Loan with Alimony and Child Support: A Clear Guide

Understanding the History of Receipt Requirement

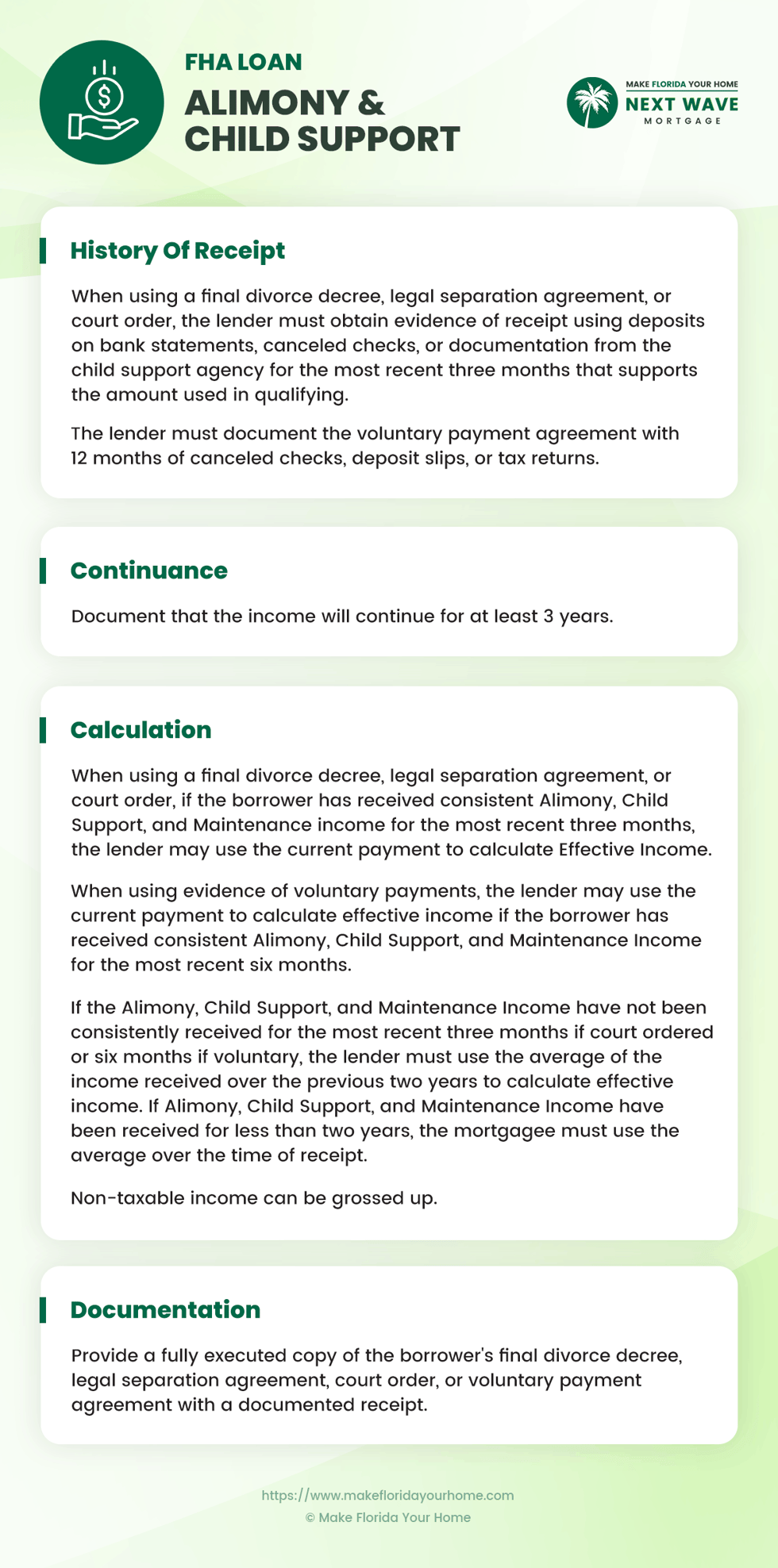

When you apply for an FHA loan and get extra money from alimony or child support, the lender will want to see that you've been getting this money regularly for a while. This is what they call 'History of Receipt.'

They're not just curious; they need to ensure this money is a stable part of your income so they can trust it'll help you pay for your house in the long run.

The 'History of Receipt' is like a track record. It shows the lender that the extra money you get from alimony or child support has been coming in steadily. Think of it as your financial attendance record.

Just like a good attendance record at school or work can show you're reliable, a good history of receipt shows lenders that you can count on this money to keep coming in. They usually want to see that it's been happening for at least three months.

So what counts as proof? Lenders usually look for documents that show the money has been deposited into your bank account or handed to you.

Here are some examples:

-

Bank Statements: These show the money coming into your account regularly. It's like a snapshot of your financial comings and goings.

-

Canceled Checks: If you get checks, showing ones that have been cashed proves you got the money.

-

Deposit Slips: If you deposit checks or cash, these slips from the bank can be proof, too.

- Tax Returns: If you report this income on your taxes, your returns can also serve as proof.

How To Establish Continuance of Income

After you've shown that you have a solid history of receiving alimony or child support, the next step is to prove that this money will keep coming in the future.

This is what lenders call 'continuance'. They want to be sure that the support payments you're getting now will continue for at least three more years.

This is because FHA loans are for people who will stay in their homes for a while, and lenders need to know you'll have the funds to make your payments down the road.

You'll usually need legal papers that say how long you're supposed to receive these payments to show that your alimony or child support will continue.

For example, a divorce decree or a legal agreement might state that you will get child support until your child turns 18. That's a legal payment promise you can show your lender.

But what if the paperwork doesn't say how long the payments will last? Or what if it's a verbal agreement without official papers?

It's a bit tougher in those cases, but you can still work with your lender. You might need to show a history of payments over a longer period or provide letters from legal experts who understand your situation.

Now, while legal documents are super important, they're not the only thing lenders look at. They're also going to consider the age of your children.

If your kids are young and you're receiving child support, the lender can guess that those payments will continue for many years. But if your kids are older, the lender might ask how likely the payments will continue for the required three years.

If you're receiving alimony, the lender might look at things like how long you were married and whether the alimony is meant to help you get back on your feet for a short time or support you over a longer term.

They might also look at whether you're working or have the potential to earn an income that could replace the alimony in the future.

Here’s a pro tip: always keep your legal documents updated. If there's a change in your alimony or child support, get it in writing.

If you've received payments without any hiccups and something changes as the amount goes up or down, ensure this is documented legally. Lenders love to see that you're on top of things and have a legal framework to ensure the payments continue.

By proving the continuity of your income from alimony or child support, you assure the lender that you're a safe bet. You're showing that not only do you have a good track record, but you're also set to receive this income for a long enough time to cover the lifespan of the loan.

Like with the history of receipt, the stronger your proof of continuance, the better your chances of getting your FHA loan approved. So gather those documents and continue your journey to a new home.

Calculating Your Effective Income

Once you've sorted out your history and continuance of income, the next thing your lender will want to figure out is your 'effective income.'

This is how much you must pay for your monthly bills and your FHA loan. For lenders, it's not just about how much you get but how much you can reliably use for your mortgage.

Now, how do they calculate this? If your payments are steady and the same amount each time, the lender will simply add up what you've received over the last few months or years.

For instance, if you've got $500 monthly from child support, and it's been that way for a while, they'll count that as part of your effective income.

Here's a simple step-by-step guide on how to do it:

Gather Your Payment Information

Collect all your alimony or child support payment records. This could be bank statements, payment stubs, or court documents that show how much you receive and when.

List Your Monthly Amounts

Write down the money you received each month. If the amount changes, note each variation.

Add and Average

If your payments are consistent, add the monthly amounts. For example, if you receive $500 a month, and you've received it for six months, that's $500 x 6 = $3000.

However, if the amounts vary, add the total received over the period you're measuring, then divide by the number of months.

For instance, if over six months you received a total of $3200, you'd calculate $3200 / 6 = about $533 per month.

Adjust for Non-taxable Income

You can' gross it up if your alimony or child support is non-taxable.' This means you increase the amount by a certain percentage (your lender will tell you the percentage, often 15-25%).

So, if your monthly average is $533 and you can gross it up by 25%, you'd calculate $533 x 1.25 = about $666.

Document Your Calculation

Write your calculations and the final monthly effective income figure. Keep this with your financial records to share it with your lender.

By carefully following these steps, you can determine your effective income from alimony or child support. Remember, this figure helps lenders understand your financial situation better and can improve your chances of qualifying for an FHA loan.

If you're unsure about the calculations or the documents you need, don't hesitate to ask a loan officer for guidance.

Another part of the puzzle is 'non-taxable income.' Some money, like certain types of child support, isn't taxed. It counts more towards your loan application because you can keep all of it.

Here's where it gets a bit more technical – lenders 'gross up' this income. That means they increase the amount for the loan application to reflect that it's not taxed.

If your lender 'grosses up' your non-taxable income by 25%, then for every $100 you get, they act like you have $125 for paying your mortgage.

Consistency in your payments is super important for your effective income. Lenders see that as a good sign if you've got the same amount coming in month after month, year after year.

It tells them you've got a reliable stream of money as dependable as a paycheck. That's why they look at your history – to see how steady your alimony and child support payments are.

The Documentation You Need to Get Approved for an FHA Loan

Getting an FHA loan means showing the lender a clear picture of your finances. This includes how much you make and where your money comes from.

If part of your income is alimony or child support, you must prove it. Here's what you should gather:

Checklist of Required Documents

-

Legal Documents: These are papers like your divorce decree, which shows you're supposed to get alimony or child support. They spell out the details: how much, how often, and for how long you'll get the money.

-

Payment Records: Bank statements or deposit slips can prove you've received these payments. If you're paid by check, keep the canceled ones or get copies from your bank.

-

Tax Returns: If you declare alimony or child support on your taxes, your returns can back up your claim.

-

Court or Agency Receipts: Sometimes, payments are tracked by a court or agency. Receipts from them are solid proof.

- Letter from the Payer: If payments are informal, a letter from the person paying might help. It should say how much they pay and that they'll keep doing it.

Understanding the Documentation

The documents you collect aren't just paper; they tell a story. They show your lender you're good for the loan because you have a steady, reliable income.

Each document plays a part:

-

Legal documents set the stage, showing the terms agreed upon.

-

Payment records are the day-to-day script, proving you're getting the money as agreed.

-

Tax returns are like the annual reviews, showing the income is recognized officially.

-

Court or agency receipts are third-party confirmations, adding credibility.

- A payer's letter is a personal promise, giving a face to the commitment.

Common Pitfalls to Avoid

When gathering your paperwork, watch out for these mistakes:

-

Old Information: Outdated documents won't reflect your current situation. Always use the most recent records.

-

Incomplete Records: Missing a month or two? That could be a problem. Lenders want the full picture without gaps.

-

Assuming Verbal Agreements Count: If it's not in writing, it's hard to prove. Get everything documented.

-

Forgetting to Gross Up: Non-taxable income can be counted for more, but you have to show it properly.

- Not Checking for Errors: Always look over your documents. Mistakes can trip you up.

Following these steps and avoiding common errors builds a strong case for your FHA loan approval. Remember, the better your documentation, the smoother your journey to homeownership will be.

FAQ's About Getting an FHA Loan With Alimony and Child Support

As you navigate applying for an FHA loan with alimony and child support income, you may have specific questions about unique circumstances or how certain changes in your life might affect your application.

Below are ten frequently asked questions with concise answers to help guide you through these considerations.

Can I qualify for an FHA loan if my alimony or child support is due to end in less than three years?

Qualification may be challenging if your support payments are set to end within three years as lenders look for income stability. However, other sources of income or a co-borrower might help strengthen your application.

What happens if my alimony or child support payments decrease after I've been approved for an FHA loan?

If your income decreases significantly, you must notify your lender immediately. They may reassess your financial situation to ensure you can still afford the mortgage payments.

Can I re-apply for an FHA loan if I've been denied previously due to insufficient alimony or child support documentation?

Yes, you can re-apply for an FHA loan. Ensure you have collected more robust documentation to demonstrate the consistency and continuance of your alimony or child support income.

How does a change in custody affect my eligibility for an FHA loan if I'm receiving child support?

A change in custody could affect your FHA loan eligibility if it significantly alters your child support income. You should inform your lender of any changes and provide updated documentation.

If I remarry, will my alimony still be considered income for an FHA loan?

Alimony may still be considered income for an FHA loan after remarriage, but this depends on the terms of your divorce decree or agreement. It's important to review the terms and consult with your lender.

Are there any special considerations for self-employed individuals receiving alimony or child support when applying for an FHA loan?

Self-employed individuals must provide additional documentation to prove their income stability, including alimony or child support. This may include tax returns and business financial statements.

What should I do if I receive alimony or child support payments in cash? How can I document this for an FHA loan application?

Keep detailed records of each transaction for cash payments, including dates and amounts. A signed receipt from the payer for each payment can also serve as documentation.

Can overdue alimony or child support payments be included as effective income once paid?

Overdue payments can be included as part of your effective income, but you'll need to prove that these payments were received and are likely to continue consistently.

If my alimony or child support payer has an inconsistent payment history, how can I strengthen my FHA loan application?

Provide as much documentation as possible to show the history of payments. A letter of explanation and any legal steps to secure consistent payments can also help.

Are there any implications for my FHA loan if I pay and receive alimony or child support?

The net amount will be considered if you're both paying and receiving support. You'll need to document both the income and the obligations to provide a clear picture of your net effective income.

The Bottom Line

Navigating the FHA loan process with alimony and child support income can be complex, but it's entirely manageable with the right preparation and understanding.

The key lies in meticulously documenting your income, staying informed about how different scenarios can impact your application, and communicating openly with your lender.

Remember, each piece of documentation you provide helps paint a clearer picture of your financial stability, making it easier for lenders to assess your loan eligibility.

Whether you're just starting out on this journey or are revisiting the process with new circumstances, keep in mind that the goal is not just to qualify for the loan but to ensure it's a sustainable financial decision for your future.

With this guide in hand, you're equipped with the knowledge to navigate the FHA loan application process confidently, moving one step closer to securing a home that suits your needs and your financial situation.

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by