FHA $100 Down Program: Requirements, Eligibility, and How It Works

Buying a home for just $100 down sounds impossible — but through a little-known HUD incentive, it’s real and happening right now.

The FHA $100 Down Program helps qualified buyers purchase certain HUD-owned homes with almost no upfront cash, making homeownership far more attainable.

Check Your FHA $100-Down Program Eligibility

In this guide, you’ll learn exactly how it works, who qualifies, and how to take advantage of it before inventory disappears.

In this article (Skip to...)

What Is the FHA $100 Down Program and Why Does It Exist?

The FHA $100 Down Program lets you buy certain HUD-owned homes with a down payment of just $100 instead of the usual 3.5% required for FHA loans. It’s designed to make it easier and cheaper for regular homebuyers to become homeowners.

So why does HUD offer this deal?

When someone with an FHA loan loses their home to foreclosure, HUD takes ownership and lists the house for sale. To help sell these homes quickly — and to real people who will actually live in them — HUD offers the $100 down incentive.

The idea is simple:

-

Homes sold to owner-occupants are usually better cared for

-

Occupied homes help improve and stabilize neighborhoods

-

HUD can clear out its inventory faster

A few key details to know:

-

You must use an FHA loan.

-

You must live in the home as your primary residence.

-

This only applies to HUD-owned properties — not regular homes or bank-owned foreclosures.

Because this program isn’t heavily advertised, many buyers don’t know it exists. But for those who do, it’s a powerful way to buy a home with almost no upfront cash.

Both first-time and repeat buyers can use it, as long as they plan to live in the property.

HUD Home Inventory and 2025–2026 Availability

Florida is a strong market for the FHA $100 Down Program because it consistently has more HUD-owned homes than most states.

These properties are most common in larger metro areas like Miami, Fort Lauderdale, West Palm Beach, Tampa, and Orlando, with occasional listings in Jacksonville, Central Florida, and smaller towns.

Foreclosure activity has ticked up slightly as the housing market cools, which may bring a modest increase in HUD listings through 2025–2026 — but inventory is still limited.

Most Florida HUD homes are sold as-is and may need repairs due to age, humidity, storms, or deferred maintenance, but they’re often priced to reflect their condition.

The biggest challenge for buyers isn’t qualifying — it’s finding a HUD home in the right area and acting quickly when one hits the market.

Buyers who stay patient, check HUD listings often, and move fast can take advantage of a rare low-cash path into homeownership.

Step-by-Step Eligibility Criteria for the $100 Down Program

To use this program, you must buy a HUD-owned home (found on HUDHomestore.com). Regular homes or bank-owned foreclosures don’t qualify. You also have to live in the home for at least one year — this is not for investors, flips, or second homes.

You must use an FHA loan and meet normal FHA guidelines. That typically means:

-

A credit score around 580+ (some lenders prefer 620).

-

Steady income and employment history.

-

Debt levels within FHA limits.

-

U.S. citizenship or legal residency.

-

No recent bankruptcies, foreclosures, or unpaid federal debt.

Not all lenders advertise this program, so you may need one familiar with HUD purchases.

When you submit an offer, HUD requires an earnest money deposit of $500–$1,000 depending on the price of the home. This money goes toward your closing costs and counts toward the $100 down when you close. If you cancel for the wrong reason, you may lose it.

In most cases, buyers offer the full list price to use the $100 down incentive. Low offers often get rejected. You must also note on the bid that you plan to use FHA financing.

You can’t have bought another HUD home within the last 24 months. This helps spread the opportunity fairly.

In Florida, the rules are mostly the same, but be aware of local factors like condo approval, flood insurance, high HOA fees, and overall insurance costs. Manufactured homes are allowed if they meet FHA standards.

In short: qualify for an FHA loan, choose a HUD home you’ll live in, make a full-price offer, and bring $100 to close.

Check Your FHA $100-Down Program Eligibility

Property Requirements and HUD Homestore Guidance (Condition Expectations)

HUD homes are listed on HUDHomestore.com and are sold as-is, meaning HUD won’t fix anything. Some homes are in decent shape, while others need repairs.

Each home gets one of three labels:

-

IN: Good enough for a normal FHA loan.

-

IE: Needs small repairs (under $5,000) that can be added into your loan.

-

UI: Needs big repairs. You’d need an FHA 203(k) rehab loan if you still want the $100 down option.

HUD uses an online bidding system. At first, only people who plan to live in the home can make offers. To get the $100 down deal, most buyers offer full list price, since low offers usually get rejected.

Because the home is as-is, you should always get a home inspection. In Florida, common issues include old roofs, AC problems, water damage, pests, and general wear and tear.

You can buy single-family homes, condos, manufactured homes, and sometimes multi-unit properties if they qualify for FHA.

The bottom line: HUD homes can be a great deal with $100 down — just expect some repairs, act fast, and choose wisely based on condition and location.

Breaking Down the Costs: What Do Buyers Pay Besides $100?

The $100 down payment is great, but it doesn’t cover everything. You’ll still need money for:

-

Earnest money ($500–$1,000) when your offer is accepted

-

Homeowners insurance and property taxes paid upfront

-

Inspection and appraisal fees (a few hundred dollars)

HUD can help by paying up to 3% of the price toward your closing costs if you ask in your offer. That can cover most of what you owe.

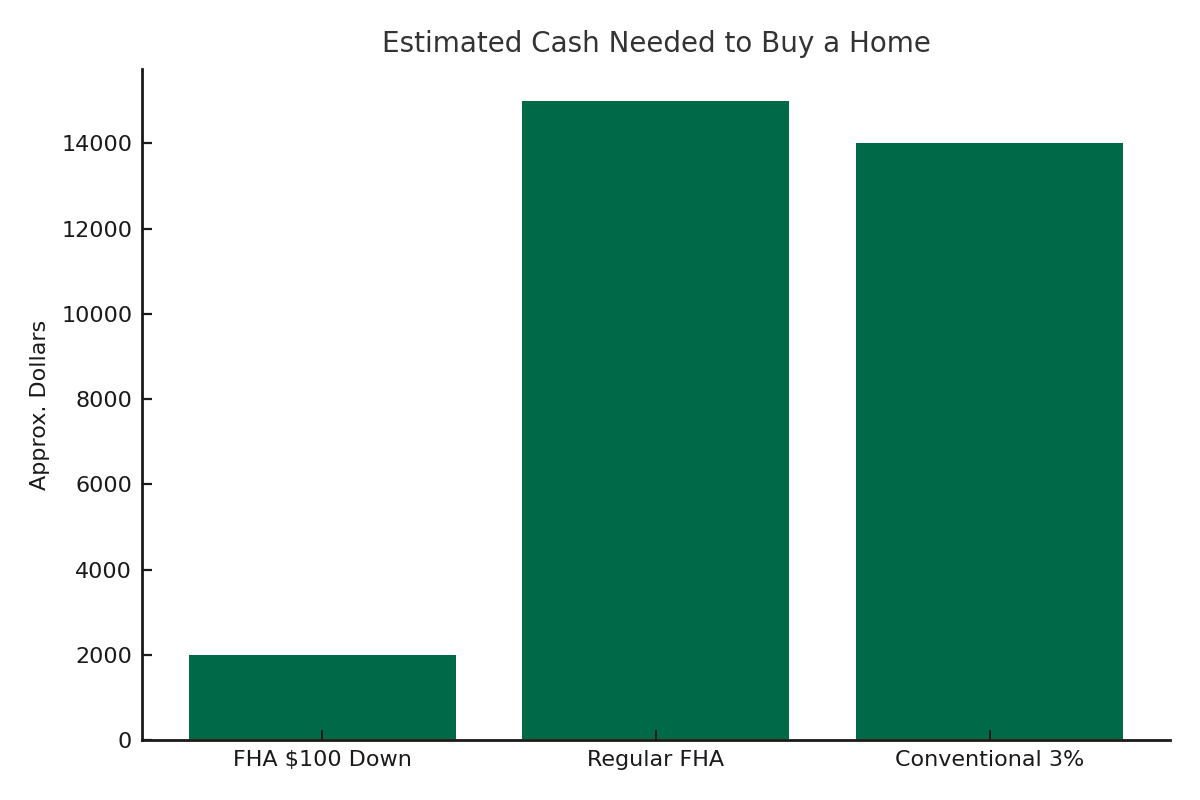

Even with $100 down, expect to bring a few hundred to a few thousand dollars to closing — still much less than a normal FHA loan.

Example Cost Comparison

| Scenario | HUD $100 Down (HUD Home, $290,000 price, $10,000 repairs financed) | Standard FHA (Regular Home, $300,000 price, no repairs) |

|---|---|---|

| Purchase Price | $290,000 (HUD-owned, as-is) | $300,000 |

| Required Down Payment | $100 | $10,500 (3.5%) |

| Repairs Financed in Loan | $10,000 | $0 |

| Closing Costs (approx.) | $9,500 | $9,500 |

| HUD Seller Credit | – $8,700 (HUD pays 3% of price) | $0 |

| Effective Cash to Close | ≈ $900 | ≈ $20,000 |

Comparing $100 Down to Other Low-Down-Payment Programs (FHA 3.5%, USDA, VA, etc.)

The FHA $100 Down program helps you buy a HUD-owned home with almost no down payment. Other programs can also get you in cheap, but they work differently:

-

Regular FHA (3.5% down): Works on almost any home, but you need more cash upfront.

-

USDA (0% down): Great if the home is in a rural-eligible area and you meet income limits.

-

VA (0% down): Best deal if you’re military-eligible — no monthly mortgage insurance.

-

Conventional 3% down: Works anywhere, but requires stronger credit.

If there’s a good HUD home available, $100 down is tough to beat. If not, USDA or VA may be better depending on location and eligibility.

Comparison Table

| Program | Min. Down Payment | Key Eligibility | Pros | Cons |

|---|---|---|---|---|

| FHA $100 Down | $100 | HUD homes + FHA-qualified | Super low down; HUD may pay 3% costs | Limited to HUD homes; bidding |

| FHA Standard | 3.5% | Any FHA-eligible home | More home choices | Higher cash needed |

| USDA Rural | 0% | Rural area + income limits | No down payment | Restricted locations |

| VA Loan | 0% | Military-eligible | No down; no monthly MI | Military service required |

| Conventional 3% | 3% | Good credit + first-time buyer | PMI removable later | Higher credit + more cash |

Myths vs. Facts About the FHA $100 Down Program

There’s an air of “too good to be true” around the idea of buying a home for $100, and that leads to some myths. Let’s debunk them:

Myth: You can use $100 down on any FHA home.

Fact: It only works on HUD-owned homes.

Myth: You can get a house for $1.

Fact: The $1 program was for local governments. Regular buyers pay $100 down, not $1.

Myth: HUD homes are always falling apart.

Fact: Some need repairs, some don’t. Condition varies. Always get an inspection.

Myth: HUD will fix problems.

Fact: Homes are sold as-is. You handle repairs yourself or use a rehab loan.

Myth: You only need $100 total.

Fact: You’ll still pay closing costs, insurance, taxes, inspections, etc. Expect a few thousand dollars total.

Myth: It’s free money from the government.

Fact: You still pay the mortgage, qualify like any FHA borrower, and prove you can afford the home.

Myth: Only first-time buyers qualify.

Fact: Repeat buyers can use it, as long as they live in the home and haven’t bought a HUD home in the last 2 years.

Myth: You can buy it and immediately rent or flip.

Fact: You must live in the home for 12 months. Breaking this rule is loan fraud.

Myth: There are income limits.

Fact: There are no income caps. Anyone who qualifies for FHA can use it.

Myth: Being approved guarantees you the house.

Fact: You must still win the bid. Stronger offers win.

Myth: HUD finances the home for you.

Fact: You get your loan through a normal FHA lender, not HUD.

Myth: Homes always sell for full price.

Fact: Hot homes do — but others may sell for less or get price drops later.

Myth: It’s only for certain jobs.

Fact: The $100 down program is open to everyone. The special discounts for teachers, police, etc. are part of a different program.

The FHA $100 Down program is real, legit, and very helpful — you just have to win the bid, live in the home, and cover closing costs like any normal buyer.

Pros and Cons of the $100 Down Program

Like any homebuying option, the HUD $100 down program has advantages and disadvantages.

Here are the key pros and cons, with an eye toward how they play out in Florida’s competitive real estate environment:

✅ Pros

-

Only $100 down

-

HUD may pay up to 3% of your closing costs

-

Competitive FHA interest rates

-

Possible below-market pricing / instant equity

-

Flexible credit + debt guidelines

-

Owner-occupants get priority over investors

-

Option to finance repairs (203(k) eligible)

❌ Cons

-

Very limited inventory

-

Many homes need repairs

-

Still requires closing costs & insurance

-

Monthly FHA mortgage insurance

-

Strict deadlines / possible extension fees

-

Higher insurance risks in Florida

-

No negotiation on repairs (as-is)

Next, we’ll discuss how you can combine the $100 down program with other assistance, potentially reducing your out-of-pocket costs even further or covering that remaining gap.

Combining FHA $100-Down with Down Payment Assistance Programs

The FHA $100 Down Program can be layered with certain down payment and closing cost assistance programs in Florida. Since the down payment requirement is already minimal, assistance funds are typically applied to closing costs, prepaid taxes and insurance, interest rate buydowns, and escrow reserves.

Statewide Programs

Florida Housing initiatives such as Hometown Heroes and Florida Assist offer second-mortgage assistance that can cover a large portion of closing costs, subject to income and purchase price limits. When combined with $100 down, buyers may need little to no cash at closing.

Local Government Programs

Many counties and municipalities provide forgivable loans or grants supported by SHIP or federal funding. These programs often target first-time buyers and can be used to reduce closing expenses. Processing timelines should be verified to avoid HUD contract delays.

Private and Employer Assistance

Nonprofit programs and employer-sponsored benefits may offset closing costs. Requirements vary and may include homebuyer education or minimum buyer contributions.

Gift Funds

FHA guidelines permit eligible gift funds to cover closing costs and earnest money. This further reduces the buyer’s personal cash requirement.

Coordination With HUD Credits

HUD can contribute up to 3 percent of the purchase price toward closing costs. When combined with assistance, buyers may choose to request a smaller HUD credit to strengthen their offer.

Timeline to Closing on an FHA $100-Down HUD Home

Buying a HUD home follows a structured process with strict deadlines. The outline below summarizes what to expect.

Pre-Approval

Get pre-approved by an FHA lender that supports the $100 Down option and work with a HUD-approved real estate agent. This ensures you can submit bids immediately when eligible homes appear.

Search HUD Listings

Monitor the HUD Homestore website and preview properties in person when possible. Inventory is limited and changes frequently.

Submit a Bid

During the initial owner-occupant period (typically seven days), your agent submits an electronic bid noting price, financing type, and any requested closing-cost credits. HUD accepts the highest net owner-occupant bid; negotiation is uncommon.

Accepted Bid

If selected, sign the HUD contract and submit the earnest-money deposit within two business days. Missing this deadline allows HUD to cancel and relist.

Inspections, Appraisal, and Loan Processing

Schedule a home inspection and allow your lender to order the FHA appraisal. Homes are sold as-is, and required repairs may be financed if eligible. Provide remaining documents for underwriting.

Closing Day

Complete a final walkthrough, sign all loan and occupancy documents, fund the transaction, and receive keys.

After Closing

Transfer utilities, file for homestead exemption when applicable, and complete any escrowed repairs within required timelines.

Frequently Asked Questions About the FHA $100 Down Program

Below are the most practical and commonly overlooked questions buyers ask when considering this program.

1. Do I need perfect credit to qualify?

No. This uses standard FHA guidelines, which allow credit scores as low as 580 with flexible approval criteria. Some lenders may prefer 600–620 for smoother processing.

2. Does the program work on any home I choose?

No. It only applies to HUD-owned homes listed on HUDHomestore.com. You cannot use $100 down on traditional resales or bank-owned foreclosures.

3. Can I combine this program with down payment or closing cost assistance?

Yes. You can layer state, county, nonprofit, employer, or gift funds to reduce closing costs. When combined strategically, many buyers bring very little to closing.

4. Can I use this on a home that needs repairs?

Yes. Minor required repairs (up to $5,000) can be financed through an escrow holdback. Larger renovations can be financed using an FHA 203(k) rehab loan alongside the $100 down program.

5. How do I compete against other buyers for HUD homes?

During the first listing period, only owner-occupants may bid—investors are blocked. Offering full list price and limiting closing cost requests improves competitiveness.

6. What happens if the appraisal comes in low?

HUD typically prices homes based on recent appraisals, so this is rare. If it happens, HUD may adjust pricing or cancel the contract. You are not required to pay more than the appraised value.

7. How long do I have to live in the home?

At least 12 months. This prevents buyers from immediately flipping or renting the property. HUD may take action if occupancy fraud occurs.

8. Can I buy a multi-unit property (duplex, triplex, fourplex)?

Yes, if the property is HUD-owned and FHA-eligible. You must live in one unit. Multi-units can help offset your mortgage with rental income from the other units.

9. How much money do I really need beyond the $100?

Expect a few thousand dollars to cover closing costs, prepaid taxes and insurance, inspections, and the earnest money deposit. HUD may contribute up to 3% to help offset these charges.

10. What happens if I cannot close within HUD’s timeline?

HUD requires financed purchases to close within 45 days. Extensions are possible but often come with daily fees. Working with an experienced HUD/FHA lender helps avoid costly delays.

The Bottom Line

If you can find the right HUD-owned home, the FHA $100 Down Program is one of the cheapest paths to homeownership in today's market. You skip the typical 3.5% down payment, can request up to 3% in seller-paid closing costs, and even finance certain repairs into your loan. That combination is almost impossible to beat.

Just remember:

-

Inventory is limited — you must act fast.

-

Homes are sold as-is — inspections are non-negotiable.

-

You must live in the property — no immediate flips or rentals.

For buyers willing to be patient, move quickly, and consider homes that may need minor work, this program can dramatically reduce out-of-pocket costs and create instant equity.

If a suitable HUD property is available in your area, the $100 Down Program is absolutely worth exploring. It’s a real, legitimate opportunity — just not one you should sleep on.

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by