How to Buy the House You're Renting with an FHA Loan: Easy Steps

In this blog, we'll walk you through the process, focusing on navigating FHA loan requirements when buying the house you're renting.

Key Points Summary

-

Understanding FHA Rules: Be aware of the FHA's Identity of Interest rule, which can limit your Loan-to-Value ratio to 85% (requiring a 15% down payment) if you haven't rented the property for at least six months before purchasing.

-

Financial Preparation: Assess your financial readiness, including credit score, down payment potential, and overall financial health, to ensure eligibility for an FHA loan.

-

Navigating the Purchase Process: Steps include confirming the Identity of Interest rule's applicability, getting pre-approved for an FHA loan, handling appraisals and inspections, finalizing the purchase agreement, and closing the deal.

- Frequently Asked Questions: Find answers to common questions about buying your rental home with an FHA loan, including credit score requirements, negotiating the purchase price, and understanding additional costs.

Understanding FHA Rules: Renters Buying Their Rental Property

When using an FHA loan to purchase the home you're renting, there are unique considerations to remember, particularly regarding the FHA's Identity of Interest rule.

Identity of Interest and FHA Loans

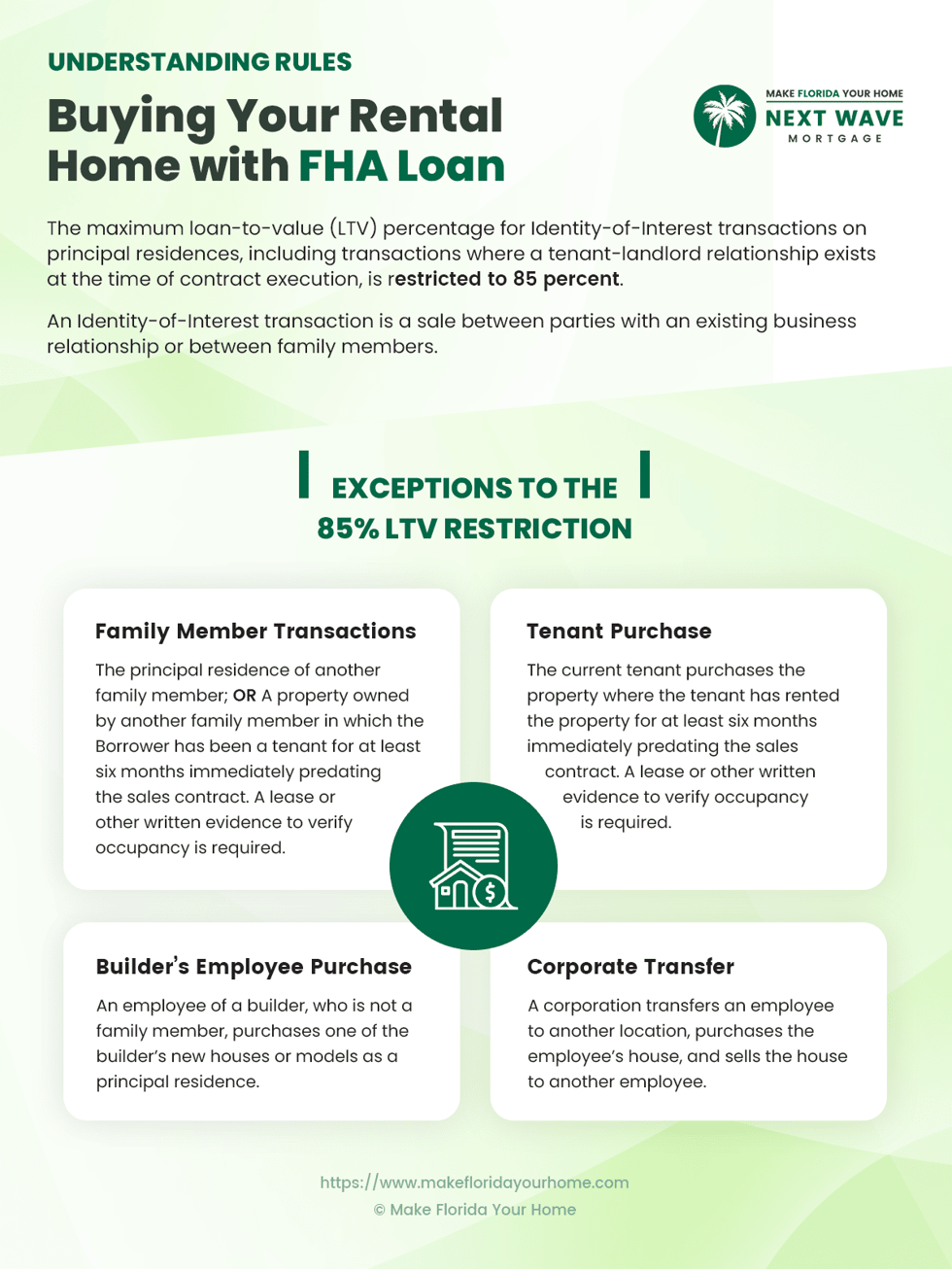

The Federal Housing Administration (FHA) is cautious about transactions where the buyer and seller have an existing relationship, known as an "Identity of Interest."

These situations are more scrutinized because the deal may not reflect true market value. The most common Identity of Interest scenario for renters involves buying a home from their landlord.

How It Affects You

If you're a renter who decides to buy the house you're renting and you choose an FHA loan for financing, here’s what you need to know:

The 85% Loan-to-Value Limitation

In standard FHA loans, you can usually finance up to 96.5% of the home's value, requiring a minimal 3.5% down payment.

However, if you enter a Sales Agreement to purchase your rental home before living there for at least six months, you'll face the Identity of Interest limitation.

This rule restricts your Loan-to-Value (LTV) ratio to 85%, meaning you’ll need a 15% down payment – significantly higher than the standard FHA loan requirement.

Planning for the Financial Impact

This limitation can be a hurdle if you haven’t prepared for the additional down payment. Knowing this requirement early in the process is crucial to ensure you have the necessary funds.

In the next sections, we'll guide you through the steps to successfully navigate these rules and make your dream of owning your rental home a reality.

Step-by-Step Guide: Buying Your Rental Home with an FHA Loan

Now that you understand the unique FHA rules for renters buying their homes, let’s dive into the step-by-step process to ensure a smooth transaction.

Step 1 - Assess Your Eligibility and Financial Readiness

Before anything else, evaluate if you're eligible for an FHA loan and financially ready to purchase. Here’s what to consider:

-

Credit Score and History: FHA loans are known for their lenient credit requirements. Check your credit score and history to ensure they align with FHA guidelines.

-

Down Payment: As discussed, prepare for the possibility of a 15% down payment if your transaction falls under the Identity of Interest rule.

- Other Financial Factors: Consider your debt-to-income ratio, employment history, and savings to ensure you’re stable enough to take on a mortgage.

Step 2 - Confirm the Identity of Interest Rule's Applicability

-

Tenancy Duration: Determine how long you’ve been renting the property. You’ll likely face the 85% LTV limitation if it's less than six months.

- Discuss with Your Landlord: Open a dialogue with your landlord about your intention to buy and how it might affect the terms of the sale.

Step 3 - Get Preapproved for an FHA Loan

-

Find a Lender: Look for a lender experienced in FHA loans. They can provide valuable guidance through the FHA loan process.

- Get Pre-Approved: Obtain a pre-approval for an FHA loan. This will give you a clear idea of your budget and strengthen your position as a buyer.

Step 4 - Appraisal and Home Inspection

-

FHA-Approved Appraisal: An FHA-approved appraiser must assess the home’s value to ensure it meets FHA standards and guidelines.

- Home Inspection: Although not a requirement for an FHA loan, getting a home inspection is crucial. It informs you of any potential issues with the property before purchase.

Step 5 - Finalize the Purchase Agreement

-

Negotiate the Sale Price: Work with your landlord to agree on a fair market price for the property.

- Sales Agreement: Draft and sign a sales agreement. Ensure it aligns with FHA guidelines and any agreed-upon terms.

Step 6 - Closing the Deal

-

Loan Processing and Underwriting: Your lender will process your loan application and conduct underwriting. Be prepared to provide any additional documentation.

- Closing Costs and Final Paperwork: Consider closing costs, typically 2% to 5% of the purchase price. Review and sign all final paperwork to close the deal.

Step 7 - Moving From Renter to Homeowner

-

Transitioning: Plan the transition from renter to homeowner. This might include addressing any existing lease agreements.

- Celebrate Your New Home: Congratulations! You’ve navigated the complexities of buying your rental home with an FHA loan.

By following these steps and being prepared for the unique challenges of this type of transaction, you can smoothly transition from a renter to a homeowner.

Every situation is unique, so you must work closely with your lender and real estate professionals to address any specific needs or concerns.

Frequently Asked Questions (FAQs) About Buying Your Rental Home with an FHA Loan

Navigating the process of buying your rental property with an FHA loan can raise many questions. To help you better understand this journey, we’ve compiled a list of the most frequently asked questions and provided clear, concise answers.

These FAQs cover everything from loan eligibility to the nuances of negotiating with your landlord, ensuring you have the information you need for a successful home purchase.

Can I use an FHA loan to buy a home I'm currently renting?

Yes, you can use an FHA loan to buy the home you're currently renting. However, if you haven’t been renting for at least six months before entering a sales agreement, you may face the 85% LTV Identity of Interest limitation.

What is the minimum credit score required for an FHA loan?

FHA loans are known for having more lenient credit requirements than conventional loans. Generally, a credit score of 580 is needed to qualify for the 3.5% down payment.

However, you can still qualify with a credit score between 500 and 579, but a higher down payment of 10% may be required.

Can I negotiate the purchase price with my landlord?

Absolutely. Just like any real estate transaction, you have the right to negotiate the purchase price. It’s important to agree on a price that reflects the home's market value, as it needs to be approved by an FHA-approved appraiser.

What should I do if I haven’t been renting for six months?

If you haven’t been renting for six months, you’ll likely face the 85% LTV limitation, requiring a larger down payment. You can either wait until the six-month period is up or prepare for the higher down payment to proceed with the purchase.

Are there any additional costs I should be aware of?

Yes, in addition to the down payment, be prepared for closing costs, which generally range from 2% to 5% of the loan amount. Also, factor in the cost of an FHA appraisal and potentially a home inspection.

What happens to my security deposit when I buy my rental home?

The treatment of your security deposit will depend on your agreement with your landlord. It could be credited towards the purchase price, returned to you, or used to cover any outstanding rent or damages per your rental agreement.

Can I still buy my rental home if I have a lower credit score?

Yes, FHA loans are more forgiving regarding credit scores. You may still be eligible if your score is between 500 and 579, but a 10% down payment will be required. It’s essential to discuss your options with an FHA-approved lender.

How long does the FHA loan process take?

The timeline can vary, but generally, the FHA loan process takes anywhere from 30 to 60 days from application to closing. However, individual circumstances, such as the need for additional documentation, can extend this timeline.

Is it mandatory to have a home inspection for an FHA loan?

A home inspection is not mandatory for FHA loans, but it is highly recommended. A home inspection can reveal potential issues with the property that might not be apparent in an appraisal.

Can I use gift funds for the down payment on an FHA loan?

Yes, FHA loans allow down payments with gift funds, provided they come from an approved source, like a family member. The donor must provide a gift letter stating that the funds are a gift, not a loan.

The Bottom Line: Turning Your Rental Into Your Dream Home with an FHA Loan

Buying the home you're currently renting with an FHA loan is a unique opportunity that combines the comfort of familiar surroundings with the excitement of homeownership.

While the process has specific nuances, particularly regarding the Identity of Interest rule and potential higher down payment, it’s a path worth considering for many renters.

Remember, preparation and understanding are the keys to a smooth transition from renter to homeowner. By being aware of the FHA rules, assessing your financial readiness, and working closely with an experienced lender, you can confidently navigate the process.

Whether negotiating the purchase price with your landlord, preparing for additional costs, or understanding the time frame, each step brings you closer to owning the home you already know and love.

In conclusion, while the journey might seem daunting initially, with the right guidance and a clear understanding of the process, buying your rental home with an FHA loan can be a fulfilling and achievable goal.

Embrace the journey, and soon, you'll be unlocking the door to a house and a place you can truly call your own.

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by