Introduction to Florida's Hometown Heroes Refinance Program

This program is designed to offer financial assistance and facilitate homeownership for essential workers in Florida. It aims to make home-buying more affordable, serving as a gesture of appreciation from the state to these vital community members.

What is the Florida Hometown Heroes Refinance Program?

The Florida Hometown Heroes Refinance Program is specifically designed as the simplest, fastest, and most effective way to refinance a loan obtained through the Florida Hometown Heroes program.

This program streamlines the refinancing process for those who originally secured their home loan under the Hometown Heroes initiative, which supports essential workers in Florida.

Its primary objective is to provide an expedited and user-friendly refinancing pathway for eligible participants, ensuring they can take advantage of improved financial terms as their needs and market conditions change.

This might include securing lower interest rates, adjusting loan terms, or accessing home equity for other financial purposes.

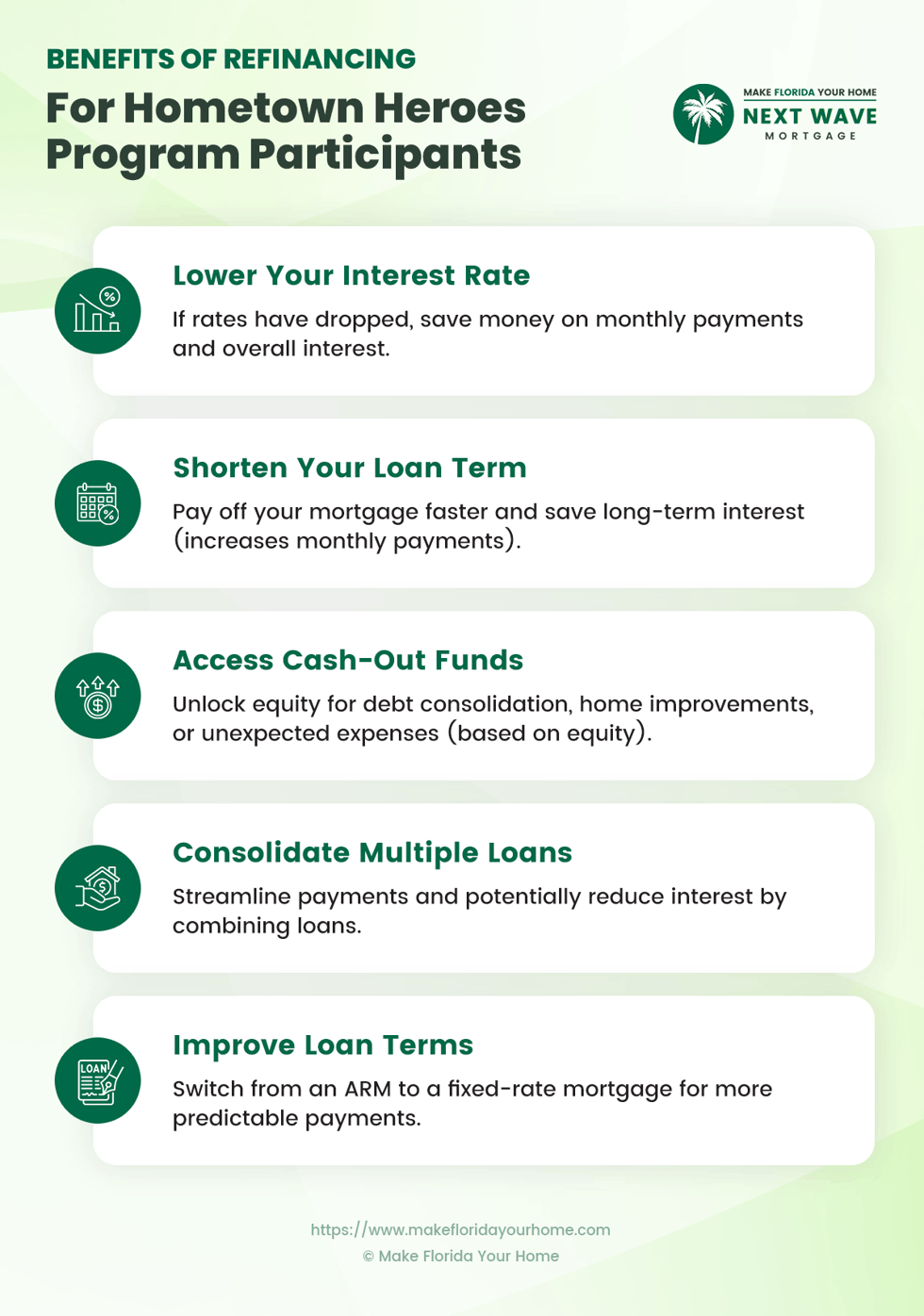

Benefits of the Hometown Heroes Refinance Program

The Hometown Heroes Refinance Program offers several benefits, particularly for those whose financial situations have changed since obtaining their original Hero Loan. One of the key advantages of refinancing is the potential to lower your interest rate.

If market rates have fallen since you first secured your loan, refinancing could lead to substantial savings in monthly payments and total interest paid over the loan's duration.

Another benefit is the ability to shorten the loan term. While this may increase your monthly payments, it enables you to pay off your mortgage quicker and save on long-term interest, which can be financially advantageous in the long run.

For homeowners who have built up equity in their property, the program also offers a cash-out refinance option. This can be particularly useful for consolidating debt, funding home improvements, or managing unexpected expenses, providing a versatile financial tool based on your home's value.

Additionally, refinancing can improve other loan terms. For example, you might switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage.

This change can offer more predictability and stability in your monthly payments, making financial planning easier and more reliable.

Eligibility Criteria for Applicants

To ensure the Florida Hometown Heroes Refinance Program is accessible to those it aims to support, there are defined eligibility criteria. As of 2024, the program now caters to all full-time Florida workers.

Applicants must meet certain financial thresholds and residential requirements, ensuring that those who contribute daily to the well-being of Florida's communities are the ones who benefit:

-

Occupation: Applicants should be employed full-time (35+ hours per week) by a Florida-based employer.

-

Military Status: Active-duty military personnel, veterans, and members of the National Guard are eligible for the program.

-

Homeownership: The program is open to first-time homebuyers and in certain cases, repeat buyers.

-

Residency Requirement: Applicants must be Florida residents and plan to occupy the purchased property as their primary residence.

-

Income Limits: The household income of applicants must not exceed 150% of the median income for their county. This threshold varies based on the county.

-

Credit Score: A minimum credit score of 640 is required to qualify for the program.

-

Debt-to-income Ratio: Applicants should have a debt-to-income ratio that does not exceed the program's maximum limit, typically 50%.

- Loan Type Eligibility: The program is compatible with several first mortgages, including FHA, VA, USDA, Fannie Mae, and Freddie Mac loans.

Understanding the Refinancing Process

Refinancing your home loan through the Florida Hometown Heroes Program is a streamlined process consisting of several key stages to facilitate a smooth experience for participants.

The journey begins with contacting a participating loan officer associated with the program. These professionals provide detailed insights into the refinancing process and evaluate whether it's beneficial for you, considering your current mortgage and financial status.

The next step involves an eligibility review. Here, you'll confirm that you meet the program's necessary criteria, including your occupation, income levels, and residency. The loan officer will assist you in this process.

Following this, you'll need to gather essential documents such as proof of income, employment verification, current mortgage statements, recent bank statements, and your credit report. These documents should be current and accurately reflect your financial situation.

Once you've compiled all the necessary documentation, your loan officer will guide you through completing and submitting the refinancing application. This application is a comprehensive overview of your financial standing and the details of your existing mortgage.

The loan processing stage follows the submission of your application. During this phase, the loan officer and processing team thoroughly review your application. They may reach out for additional information or clarifications.

Upon approval of your application, you'll receive a closing disclosure that outlines the terms of your new loan. It's crucial to review these terms carefully.

Following your agreement to these terms, a closing date is set. The closing process involves signing the new loan documents and officially completing the refinancing process.

After closing, the final stage is post-closing, where you start making payments according to the terms of your newly refinanced loan.

FAQs About Florida's Hometown Heroes Program

This section aims to answer the most common questions about Florida's Hometown Heroes Program, offering clear and concise information for potential applicants and those interested in understanding more about the program.

Who is Eligible for the Hometown Heroes Program?

Eligibility for the program include full-time employment by a Florida-based employer. Residency in Florida and an intent to use the purchased home as a primary residence are required.

First-time homebuyers, some repeat buyers, healthcare workers, teachers, law enforcement officers, firefighters, active-duty military, veterans, National Guard members and military personnel are also eligible.

What are the Financial Requirements for the Program?

Applicants must have a household income below 150% of their county's median income. A minimum credit score of 640 and a debt-to-income ratio not exceeding the program's maximum (usually 50%) are also required.

Can the Program Be Used for Refinancing?

Yes, the program offers refinancing options for those with a Hero Loan. Refinancing can help lower interest rates, shorten loan terms, access equity for cash-out, or improve overall loan terms.

What Types of Loans are Available?

The program is compatible with various loan types, including FHA, VA, USDA, Fannie Mae, and Freddie Mac first mortgages.

How Does the Application Process Work?

The application process involves contacting a participating loan officer, verifying eligibility, gathering necessary documents, submitting an application, and going through loan processing, appraisal, underwriting, and closing.

What Are the Benefits of the Hometown Heroes Program?

Benefits include reduced interest rates, favorable loan terms, sustainable homeownership opportunities, financial relief, and enhanced stability and security for essential workers in Florida.

Is There Assistance Available for the Application Process?

Yes, participating Florida Housing loan officers at MakeFloridaYourHome are available to assist applicants throughout the process, from initial inquiry to final approval. They guide eligibility, documentation, and any other questions related to the program.

Conclusion

In conclusion, the Florida Hometown Heroes Program stands as a significant initiative, acknowledging and supporting the vital roles played by essential workers in our communities.

Through this program, Florida offers a token of gratitude and provides tangible assistance in making homeownership more affordable and sustainable for these dedicated individuals.

The Florida Hometown Heroes Refinance Program, a key component of this initiative, is tailored to be the most straightforward, quick, and effective way for participants to refinance their existing Hero Loans.

This refinancing option ensures that essential workers can adapt their mortgage terms to suit changing financial circumstances through lowering interest rates, shortening loan terms, accessing equity, or improving overall loan conditions.

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by