Refinancing Your FHA Loan Quickly: What to Know if It's Been Less Than a Year

However, it's important to understand the nuances and requirements involved in this process. This article provides a comprehensive guide for those considering refinancing their FHA loan in under a year.

Table of Contents

Key Points: Refinancing an FHA Loan Within the First 12 Months

-

Loan-to-Value (LTV) Ratio Calculation: When refinancing an FHA loan within the first year, calculate the LTV ratio using the lower of either the home's purchase price plus improvements or its current market value.

-

Payments: You'll need to make six payments on your FHA loan before you can refinance.

-

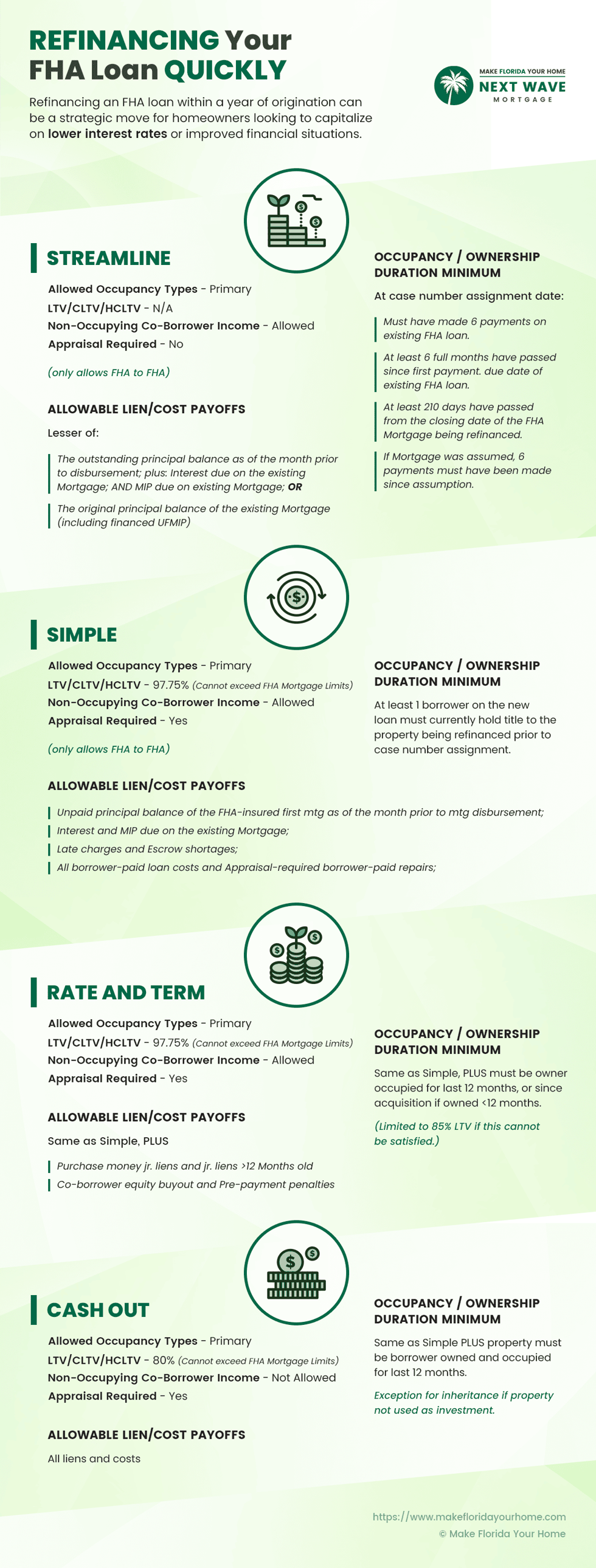

Streamline Refinance Rules: Need at least six payments on the current FHA loan, six months since the first payment, and 210 days since the loan's start. If the mortgage was assumed, six payments must be made post-assumption.

-

Simple Refinance Rules: One borrower on the new loan must hold the title to the property before getting a new case number for refinancing.

- Cash-Out Refinance Rules: Similar to Simple Refinancing, the borrower must have lived in and owned the property for the past 12 months. There's an exception for inherited properties not used as investments.

Rules for Refinancing an FHA Loan Within The First 12 Months

Refinancing an FHA loan within the first year of homeownership comes with specific rules, particularly regarding calculating the Loan-to-Value (LTV) ratio.

When you refinance an FHA loan within 12 months of acquiring your home, the calculation of the LTV ratio is unique.

The LTV ratio is a critical factor in determining your eligibility for refinancing as it represents the amount of your loan in relation to the value of your property.

The rules state that the LTV must be calculated based on the lower of the following:

-

Borrower's Purchase Price + Improvements: This is the home's original purchase price plus the cost of any documented improvements you have made since the purchase. Improvements must be substantial and documented to be considered in this calculation.

- Current Property Value: The property's current market value as determined by an appraisal.

Types of Refinancing

Streamline Refinancing

Designed for existing FHA loan holders, streamline refinancing offers a simplified process with minimal documentation requirements. It's ideal for reducing interest rates or transitioning from an adjustable-rate to a fixed-rate loan.

Cash-Out Refinancing

This option allows homeowners to refinance their mortgage for more than they owe and take the difference in cash. However, it typically requires at least 15% equity in the home.

Simple Refinancing

Simple Refinancing is another option under the FHA program, though it's less commonly discussed than Streamlined and Cash-Out refinancing.

This method involves refinancing your existing FHA loan into a new one, often to take advantage of better interest rates or loan terms.

The primary requirement for Simple Refinancing is that at least one borrower on the new loan must currently hold the title to the property being refinanced before the case number assignment.

Now, here's a detailed look at the rules for Streamline, Simple, and Cash-Out refinancing:

Streamline Refinance Rules

Streamline refinancing is designed for those with an FHA loan who want to lower their monthly payments or switch from an adjustable to a fixed-rate mortgage.

The rules for this type of refinancing are as follows:

-

Payment History: You must have made at least six payments on your existing FHA loan.

-

Time Since First Payment: At least six months must have passed since the first payment due date on your existing FHA loan.

-

Time Since Loan Origination: At least 210 days must have passed from the closing date of the FHA mortgage being refinanced.

- Post-Assumption Payments: If the mortgage was assumed, the borrower must have made at least six payments since the assumption.

Simple Refinance Rules

Simple refinancing is another option for FHA loans, typically involving more straightforward criteria. The key rule here is:

- Title Holding: At least one borrower on the new loan must currently hold the title to the property being refinanced before the case number assignment.

Cash-Out Refinance Rules

Cash-out refinancing allows borrowers to refinance their mortgage for more than they owe and receive the difference in cash.

The rules for this type of refinancing include the criteria for Simple refinancing with additional requirements:

-

Title Holding: As with Simple refinancing, at least one borrower must hold the title to the property before the case number assignment.

-

Owner Occupancy: The borrower must have owned and occupied the property for the last 12 months. This rule ensures that the property is the borrower's primary residence.

- Exception for Inherited Properties: There's an exception for inherited properties. If the property was inherited and has not been used as an investment property, the borrower may still qualify for Cash-Out refinancing.

Benefits of Early FHA Refinancing

-

Lower Interest Rates: If interest rates have dropped since you took out your FHA loan, refinancing can lock in a lower rate, reducing your monthly payments and overall interest.

-

Remove or Reduce Mortgage Insurance: FHA loans require insurance premiums (MIP). Refinancing can reduce or eliminate these costs if you've built up sufficient equity.

- Fixed-Rate Security: Switching from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage can offer stability in monthly payments.

Considerations Before Refinancing

When considering refinancing your FHA loan, it's crucial to consider several key factors that can significantly impact the financial viability of this decision.

One of the primary considerations is the closing costs associated with refinancing. These costs can be substantial and vary depending on the lender and the specifics of your loan.

Therefore, it's essential to carefully evaluate whether the potential savings from refinancing justify these upfront expenses.

This assessment involves a thorough analysis of your current mortgage terms compared to the proposed terms, factoring in all fees and costs associated with the refinancing process.

Another important aspect is the breakeven point: the period it takes to recoup refinancing costs through the savings you gain from the new loan terms. This is particularly relevant if you have plans to move or sell your home shortly.

If the time it takes to reach the breakeven point exceeds the duration you plan to stay in your home, refinancing may not be a cost-effective choice.

Additionally, you should consider the potential extension of your loan term. While refinancing might offer lower monthly payments, it often extends the length of your loan.

This means that you could end up paying more in total interest over the life of the loan despite the immediate relief in monthly expenses.

Carefully weighing these factors will help you make a more informed decision about whether refinancing is the right financial move for you.

The Refinancing Process

-

Financial Assessment: Evaluate your current financial situation, including credit score, employment status, and debt-to-income ratio. A strong financial profile can qualify you for better rates.

-

Shop for Lenders: Compare rates and terms from multiple lenders to find the best deal.

-

Gather Documentation: Prepare necessary documents such as proof of income, employment verification, and current mortgage statements.

-

Apply for Refinancing: Once you choose a lender, complete the application process and provide all required documentation.

- Closing: If approved, you’ll close on the new loan. This involves signing a new mortgage agreement and paying closing costs.

Conclusion

Refinancing your FHA loan within a year is a decision that should be based on current mortgage rates, your financial situation, and long-term housing plans. While it offers potential savings and financial benefits, it's crucial to consider the costs and implications.

Always conduct thorough research and consult with financial advisors or mortgage specialists to make an informed decision.

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by