How to Count Extra Income for Your FHA Loan: Overtime, Tips, Bonuses

However, many potential borrowers don't often fully grasp the impact of extra income – such as overtime, tips, and bonuses – on their loan eligibility and overall borrowing capacity. This extra income can significantly influence the amount one can borrow and the terms of the loan.

In this guide, we delve into how FHA loans consider these additional income streams, shedding light on a subject that can be a game-changer for many applicants.

Understanding FHA Loan Basics

FHA loans, insured by the Federal Housing Administration, are a beacon of hope for first-time homebuyers and individuals with less-than-perfect credit scores. These loans are designed to make homeownership accessible to a broader demographic.

The appeal of FHA loans lies in their minimal down payment requirements – as low as 3.5% – and more relaxed credit score thresholds. These features make the dream of owning a home more attainable for those who might not qualify for conventional loans.

An often overlooked aspect of FHA loan eligibility is the role of extra income. For many borrowers, income isn't just a simple matter of a monthly salary. Overtime, tips, and bonus payments can form a significant part of their earnings.

FHA loans offer the flexibility to include these additional income sources in the loan qualification process, potentially increasing the loan amount one can qualify for.

This inclusion demonstrates the FHA's commitment to accommodating diverse financial situations and opens doors for applicants to leverage their total earning capacity.

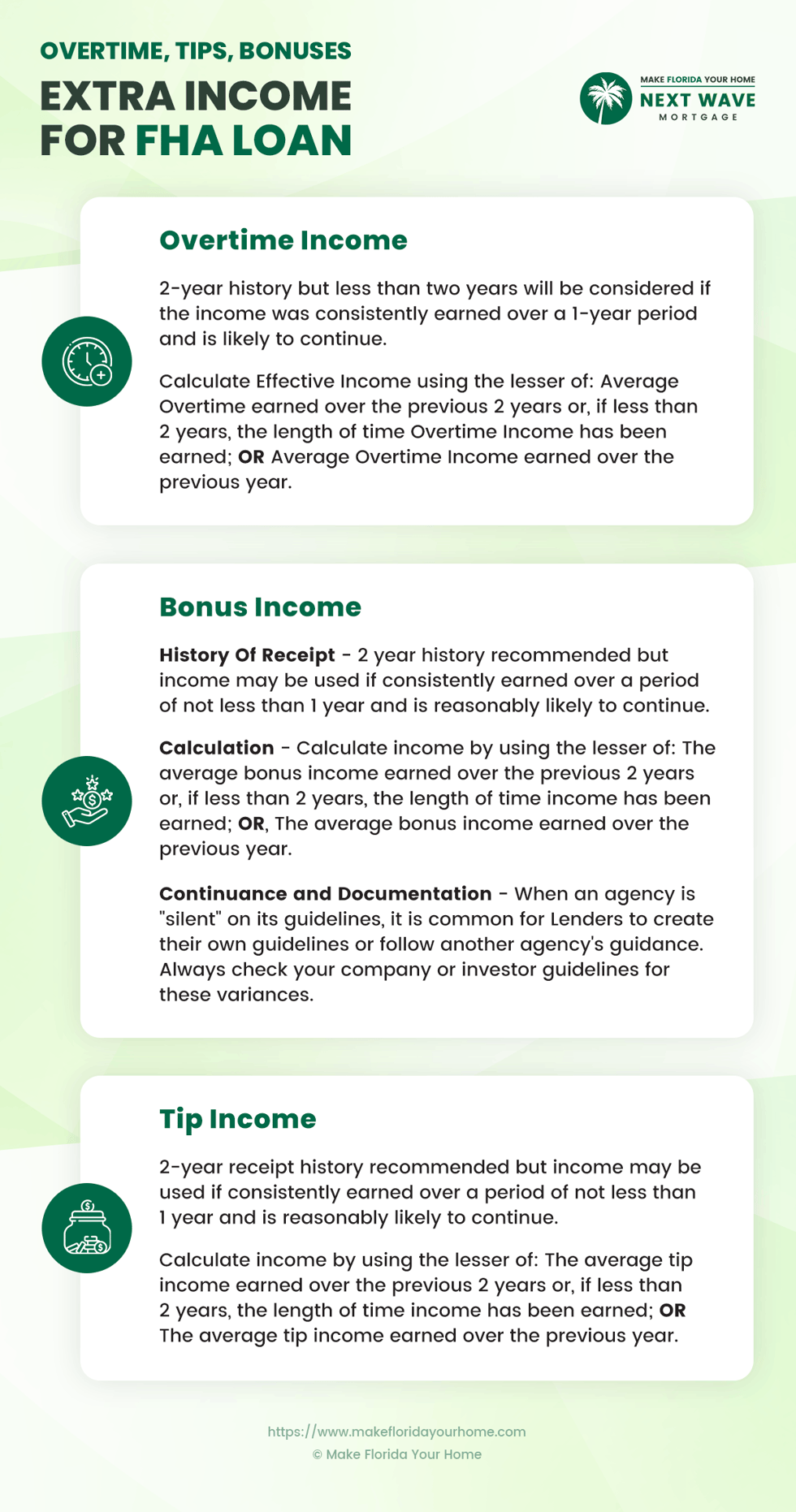

Overtime Income and FHA Loans

Understanding how FHA lenders view overtime income is crucial for applicants who regularly earn beyond their base salary.

Lenders scrutinize overtime income to ensure consistency and sustainability, impacting how much they're willing to lend. The key criterion here is the two-year rule.

FHA lenders typically require that applicants have received overtime income for at least the past two years to be considered part of their regular income. This requirement ensures that the overtime income is stable and reliable.

However, there are exceptions to this rule. Lenders may still consider it if an applicant has been receiving overtime income for less than two years but can demonstrate consistency and likelihood of continuance.

For instance, an employee in the healthcare sector receiving consistent overtime for 18 months due to high demand in their field might be considered favorable.

To illustrate, let's consider a case example: Jane, a nurse, has been working regular overtime shifts for the past 20 months.

Her regular salary is $50,000 annually, but she earns an additional $15,000 annually with overtime. An FHA lender will look at Jane's overtime history to determine if it’s a reliable part of her income.

In this scenario, despite not meeting the two-year threshold, the consistent nature of her overtime in a high-demand sector could qualify her for a higher loan than her base salary alone would allow.

This approach underscores the FHA’s adaptability in considering varying income patterns, providing a more inclusive and realistic assessment of an applicant's earning capacity.

It's a recognition that in today's dynamic job market, income can fluctuate and extend beyond the confines of a regular salary.

By accommodating these variations, FHA loans stand out as a practical and accessible option for a wide spectrum of borrowers, ensuring that their total income, including overtime, is fairly considered in the loan application process.

Counting Bonus Income

Regarding FHA loans, bonus income can be pivotal in your application. The FHA lending guidelines require this income to be consistent for at least two years before it can be considered part of your effective income.

This ensures that your bonus is not a one-off occurrence but a steady component of your earnings. Having all your documentation in order is crucial to present this effectively to your lender.

Gather your pay stubs and W-2 forms that distinguish your bonus from your regular salary. If your bonus amounts have fluctuated over the years, be prepared to explain.

For example, a higher bonus in a particular year might be due to exceptional company performance. In such cases, a letter from your employer or a personal explanation can be beneficial.

It's also wise to consider your application's timing; if you’re expecting a bonus soon, applying after this is reflected in your pay might be advantageous.

Tips Income in FHA Loan Calculations

For those whose income includes a significant amount of tips, such as workers in the service industry, FHA loans offer the opportunity to include this in your income calculation.

The key to maximizing this opportunity lies in thorough and consistent documentation. Maintaining a regular record of the tips you earn is essential. This assists in accurately reporting your income for taxation and is crucial for your mortgage application.

Your tax returns are particularly important as they provide documented proof of your declared tip income over the past two years.

Additionally, a verification letter from your employer stating that you regularly receive tips can further strengthen your loan application.

When combining tip income with other forms of income like salary or overtime, ensure that all your income sources are clearly and cohesively presented. This helps the lender to assess your total income easily.

If your tip income varies, as it often does in industries like hospitality, it’s important to show its overall consistency over time. If you’ve been in the same industry or role for a long time, this longevity can help demonstrate the stability of your income.

Consulting with a mortgage advisor or loan officer experienced in dealing with borrowers earning tip income can also provide valuable insights, helping you present your income in the most favorable light for an FHA loan application.

Documentation and Verification

In the FHA loan application process, verifying your income through proper documentation is critical. Lenders need to be assured of the consistency and reliability of your income, whether it's from regular wages, overtime, tips, or bonuses.

For this, various documents are required. W2s and pay stubs are fundamental as they clearly record your earnings. These should ideally reflect the breakdown of your regular and additional incomes. These documents should show a history of these earnings over the past two years regarding bonuses and overtime.

For tips, maintaining a daily or weekly log can be beneficial, and this should be corroborated by your tax returns where these amounts are declared.

Employer verification is another key aspect of the documentation process. A letter from your employer that confirms your income details, including the likelihood of continued earnings, can greatly support your application.

This letter becomes particularly important when there are fluctuations in your income or when you haven’t yet reached the two-year mark for consistent extra income.

The role of lenders in this process is to scrutinize and verify the information provided. They ensure your income is stable, dependable, and likely to continue.

As an applicant, you can facilitate this process by organizing your documents meticulously and providing comprehensive and clear information.

Being proactive in gathering and presenting all necessary documentation can streamline the verification process and improve your chances of loan approval.

Overcoming Challenges with Extra Income

One common challenge in the FHA loan application process is navigating the requirements for extra income such as overtime, tips, and bonuses. A prevalent misconception is that only consistent income over a two-year period will be considered.

While it's true that a two-year history is ideal, there are circumstances where income of less than two years can be included, provided it can be shown to be stable and ongoing.

For applicants facing this challenge, the strategy lies in substantiating the reliability of your income. If you have less than two years of extra income, provide as much evidence as possible to show its consistency.

For example, if you started receiving overtime or bonuses recently, but these are linked to a stable aspect of your job, document this. A letter from your employer or detailed records can help demonstrate the regularity and likelihood of continuation of this income.

Another important factor is to be upfront about any fluctuations in your income. If significant changes have occurred in your extra income amounts, be prepared to explain these.

An honest and transparent approach, backed by solid documentation, can help lenders better understand your financial situation.

Lastly, consulting with a loan officer or a mortgage advisor is advisable early in the process.

Their expertise can guide you in preparing your application, especially if your income situation is complex. They can offer tailored advice on presenting your income best, considering FHA guidelines and lender expectations.

This guidance can be invaluable in navigating the challenges and ensuring that your extra income is counted effectively in your FHA loan application.

Frequently Asked Questions About FHA Loans and Extra Income

I haven't received overtime for two years. Can it still be included in my loan application?

While a consistent 2-year history is ideal, FHA guidelines allow exceptions if you can demonstrate stability. Provide documentation and explanations, like an employer letter confirming ongoing overtime due to high demand in your field.

My bonus income fluctuates. Can I still use it for my application?

Yes, but be prepared to explain fluctuations. Show overall consistency over time through tax returns and industry longevity. Consulting a loan officer for guidance is recommended.

How do I document tip income for my FHA loan application?

Maintain a daily/weekly log and verify employer letters and tax returns reflecting declared tip amounts. Combine your tip income with other earnings clearly for easy assessment by the lender.

What happens if my extra income doesn't meet the usual requirements?

Be upfront about any variations. Back your explanations with solid documentation like employer letters or detailed records. Consulting a loan officer early on can help you navigate challenges and present your income effectively.

I'm expecting a bonus soon. Should I delay my application?

Timing can be strategic. If the bonus significantly impacts your loan eligibility, waiting until it's reflected in your pay could be advantageous.

Remember, thorough documentation, clear explanations, and seeking professional guidance can significantly improve your chances of having your extra income considered effectively in your FHA loan application.

I'm self-employed. How can I prove my extra income for an FHA loan?

Tax returns and bank statements become even more crucial if you're self-employed. Provide detailed records of your income and expenses, showcasing consistent earnings over the past two years. Consider consulting a tax professional to ensure your documentation aligns with FHA guidelines.

What if I've recently switched jobs and not established consistent extra income yet?

New job situations might not have a two-year track record. Highlight your previous income history and provide any available documentation for your new income, like offer letters or pay stubs. Explain your income stream's expected continuation with future pay stubs or employer verification.

Can I combine different types of extra income, like overtime and bonuses, for my FHA loan application?

Absolutely! As long as you can document each income source consistently over the past two years, combining them can increase your total qualifying income and potentially raise your loan approval amount. Present all income streams clearly and cohesively for easy lender assessment.

I have some gaps in my employment history. How will that affect my chances of getting an FHA loan with extra income?

Gaps in employment don't automatically disqualify you. Be prepared to explain the reasons for these gaps and demonstrate your current financial stability through consistent recent income and a low debt-to-income ratio. Highlighting your extra income can further strengthen your application.

Are there any limitations on how much extra income I can include in my FHA loan application?

With no specific limit, lenders will assess the reasonableness and sustainability of your income sources. Extra income exceeding your base salary significantly might raise questions. Present a realistic picture of your financial situation with verifiable documentation.

Bottom Line

Navigating the FHA loan application process with varied income sources like overtime, tips, and bonuses can be intricate, but it's feasible with the right approach and documentation.

The key lies in understanding the FHA's guidelines, presenting your income effectively, and being well-prepared with all necessary documentation. Remember, lenders seek stability and reliability in your income; your documentation proves that.

While the two-year history rule for extra income is a standard benchmark, there are exceptions and flexibilities within the FHA framework.

Don't be discouraged if your extra income history is less than two years. Provide clear evidence of the stability and likelihood of continuation of this income. Be transparent about any fluctuations in your earnings and be ready to explain if needed.

Your relationship with the lender is also pivotal. A well-organized and forthright approach can build trust and facilitate a smoother verification process.

Don't hesitate to seek advice from loan officers or mortgage advisors, especially if your income situation is complex or unusual. Their expertise can provide valuable insights and help you navigate the nuances of the FHA loan application process.

In conclusion, while the process might seem daunting initially, understanding how to count extra income for your FHA loan can open doors to homeownership that might otherwise seem closed.

With careful preparation and guidance, you can effectively leverage your full earning potential to achieve your dream of owning a home. Remember, the effort you put into accurately presenting your income can significantly impact your FHA loan journey.

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by