Accepting Gift Money for Your FHA Loan: What You Need to Know

One significant aspect of FHA loans that often confuses borrowers is the concept of accepting gift money.

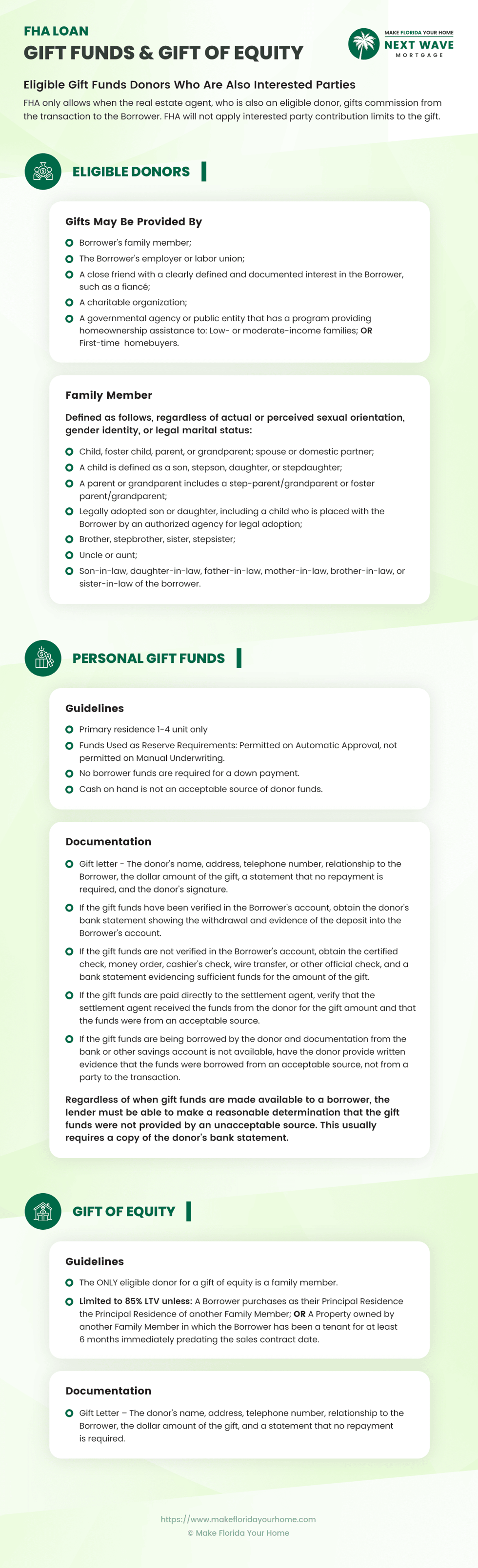

This is particularly relevant when real estate agents, who are also family members, wish to gift their commission from the transaction or when close friends with a vested interest in the borrower's wellbeing want to contribute financially.

What Are FHA Gift Funds?

FHA gift funds constitute cash or other assets given to a borrower without any requirement of repayment. These funds serve as financial support from a donor to a borrower who may not have the means to independently cover the costs associated with an FHA mortgage loan.

For instance, a borrower can utilize these funds to assist with closing costs, contribute to their down payment, or enhance their cash reserves.

Consider a scenario where a parent decides to sell their house, valued at $500,000, to their adult child for just $250,000. This transaction gives $250,000 in equity to the borrower.

The adult child can leverage this equity as a substantial down payment, aiding in securing an FHA mortgage loan.

What is an FHA Loan?

An FHA loan, underwritten by the Federal Housing Administration, is a non-conventional loan often chosen by borrowers with lower credit scores or limited funds for a down payment as an alternative to standard loan options.

The federal government insures FHA loans, thereby reducing the lending risk.

Owning a home is costly, and securing a mortgage can be daunting. FHA home loans ease these challenges by relaxing certain financial criteria for borrowers.

For instance, they provide a path to homeownership for those who might not have the credit score necessary for a traditional, bank-backed conventional or USDA loan.

FHA gift funds are specifically for FHA loans, and borrowers need to satisfy certain conditions to qualify for an FHA mortgage loan:

-

The property must be the borrower's primary residence.

-

The borrower should move into the property within 60 days post-closing.

-

The property must meet the FHA's minimum property standards per an inspection.

-

The borrower must be capable of affording the mortgage insurance premium (MIP) for the loan.

-

An FHA-approved appraiser must determine the home's value.

-

Borrowers with a credit score of 580 or above must make a down payment of 3.5% of the purchase price.

- Those with credit scores between 500 – 579 must have a down payment of at least 10%.

FHA gift funds are particularly beneficial for borrowers, especially those with credit scores of 579 or lower who need to make a larger % down payment of 10%.

For example, a borrower eligible for an FHA loan of $150,000 might not have the $15,000 required for a down payment.

In such cases, FHA gift funds can provide the necessary support to meet the minimum down payment requirement and secure the loan.

The Most Common Problems to Watch Out For With Gift Funds

While these funds offer a pathway to homeownership by helping cover down payments and closing costs, they come with a set of specific challenges that need careful attention.

Understanding the most common issues and their solutions is crucial for a smooth FHA loan process. Common Gift Fund Problems and Solutions in FHA Loans includes:

Source Verification

The FHA requires thorough verification of the gift fund's source to ensure it's a genuine gift and not a loan.

Solution

Provide a detailed gift letter from the donor stating their relationship to the borrower, the amount of the gift, and explicit confirmation that no repayment is expected.

Family Member Real Estate Agent Donations

When a family member who is also a real estate agent gifts their commission, it adds another layer of complexity due to dual roles.

Solution

Ensure full disclosure and compliance with FHA guidelines and real estate regulations, providing clear documentation about the nature of the gift and its relation to the transaction.

Documentation of Fund Transfer

The lack of clear, traceable documentation for the transfer of gift funds can lead to FHA loan approval delays.

Solution

Provide bank statements or other financial documents that clearly trace the transfer of funds from the donor to the borrower, demonstrating transparency.

Donor’s Ability to Gift

Sometimes, there's scrutiny over whether the donor has the financial capacity to give the gift without affecting their financial stability.

Solution

Donors may need to provide proof of their financial ability to gift, such as bank statements or other financial records.

Gift Letter Requirements

Incomplete or incorrectly formatted gift letters are a common issue.

Solution

Use a template or consult with a loan officer to ensure the gift letter meets all FHA requirements, including all necessary details and signatures.

How Do FHA Gift Funds Work?

To facilitate a smooth transaction with FHA gift funds, donors must adhere to a well-defined procedure that benefits both themselves and the borrower.

Initially, the donor needs to clarify their motivation for the gift in a formal gift letter. This step is crucial to assure HUD that the funds are not a loan but a genuine gift.

Subsequently, both the donor and the borrower must present bank statements illustrating the money's movement from the donor's account to the borrower's. These statements serve as conclusive evidence of the gift's amount and the date it was transferred.

Following these guidelines simplifies the process for borrowers to accept cash gifts. Additionally, donors can provide gifts of equity instead of cash.

In such cases, the donor typically sells their property to the borrower at a value significantly lower than the market rate.

FHA Gift Funds Vs. FHA Gift Letter: What's the Difference?

Utilizing gift funds can be a powerful strategy for homebuyers using an FHA loan, but it's essential to document this properly with a gift letter.

This letter is crucial in clarifying the nature of the gift, ensuring it facilitates rather than complicates the home buying process.

It details the relationship between the donor and the borrower, confirming that the funds are a gift and not a loan, thereby not impacting the borrower's mortgage affordability.

In the home buying process, you're typically required to show bank statements to your lender, demonstrating your ability to make mortgage payments.

The Department of Housing and Urban Development (HUD) checks for consistent income and steady cash flow. A large, one-time deposit, such as a gift, can raise questions for underwriters evaluating your financial health.

This is where the importance of a gift letter is underscored.

Required for any gift exceeding 1% of the higher value between the home's purchase price and its appraisal, the letter must state unequivocally that the funds are a gift, with no expectation of repayment.

If not, the funds could be misconstrued as an additional loan, impacting your mortgage payment capability.

A comprehensive gift letter should include:

-

The donor's full name, address, and contact number.

-

The nature of the relationship between the donor and the recipient.

-

The exact amount of the gift.

-

The reason behind the donor's decision to give the gift.

-

A clear statement from the donor that there is no obligation or expectation for repayment.

-

The address of the property being purchased.

- The donor's signature for verification.

While donors have the liberty to give generously without affecting the borrower's tax situation, there are potential tax implications for the donor depending on the size of the gift. As of 2023, an individual can gift up to $17,000 annually to another person without triggering any gift tax.

Frequently Asked Questions About Gift Funds for FHA Loans

Navigating the complexities of using gift funds for an FHA loan can bring up many questions. Below are answers to some of the most frequently asked questions to help you understand this process better.

Can gift funds be used for the entire down payment on an FHA loan?

Yes, gift funds can cover the entire down payment, but the borrower still needs to meet all other FHA loan requirements.

Are there restrictions on who can be a gift donor for an FHA loan?

Generally, donors should be family members, close friends with a documented relationship, or an employer. Other donor types may require additional scrutiny.

How does a gift of equity work in an FHA loan scenario?

A gift of equity involves a property being sold below its market value, with the difference in value being considered a gift. This can count towards the borrower's down payment.

Is there a limit to the amount that can be gifted for an FHA loan?

There's no specific limit on the gift amount for FHA loans, but any gift over 1% of the property's value or purchase price (whichever is higher) requires a gift letter.

Do gift funds affect the borrower's debt-to-income ratio for FHA loan eligibility?

Gift funds do not affect the debt-to-income ratio as they are not considered a debt. However, all other debts of the borrower will still be considered in the loan qualification process.

What documentation is required from the donor when providing gift funds?

The donor must provide a gift letter and may also need to show proof of their ability to give the gift, such as bank statements.

Can a borrower receive multiple gifts from different donors for an FHA loan?

Yes, a borrower can receive gifts from multiple donors, but each gift must be documented correctly with a separate gift letter.

Are there tax implications for the donor when giving a large gift?

While there are no tax implications for the borrower, donors may face gift tax implications if the amount exceeds the annual exclusion limit set by the IRS.

How do lenders verify the source of gift funds for FHA loans?

Lenders will typically require bank statements from both the donor and borrower to trace the transfer of funds and ensure it's a genuine gift.

Can gift funds be returned to the donor after closing on an FHA loan?

No, once the gift funds are used in the transaction, they cannot be returned to the donor. The essence of a gift is that it's a one-way transfer with no expectation of repayment.

The Bottom Line

FHA loans significantly widen the possibilities for individuals seeking to buy a home, particularly those who might find traditional financing challenging.

Supplementing these loans with FHA gift funds can be a game-changer, providing essential support for down payments, closing costs, or bolstering mortgage reserves.

To be eligible, these funds need to originate from a recognized source and be accompanied by a gift letter that absolves the borrower of any repayment obligations.

Gift funds can be either direct cash contributions or a gift of equity in the property being purchased, enhancing the accessibility of FHA loans for many prospective homeowners. This flexibility is key in enabling more individuals to proceed with their home purchases once they secure FHA loan approval.

If you're contemplating an FHA loan for your property acquisition, why not take the first step in your mortgage journey today? Reach out to our Home Loan Experts at MakeFloridaYourHome for personalized guidance and to explore your home loan options.

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by