The 8 FHA Loan Requirements in Florida in 2024

From credit score minimums to down payment guidelines, we cover the crucial details to help you understand what it takes to qualify for an FHA loan in the Sunshine State.

Before delving into the specifics of FHA loan requirements in Florida, it's essential to understand that these guidelines are designed to make homeownership more accessible, especially for first-time buyers and those with less-than-perfect credit histories.

These loans, backed by the Federal Housing Administration, provide unique opportunities and flexibilities that are not always available with conventional mortgages.

FHA Credit Score Requirements

The credit score is pivotal in determining eligibility for an FHA loan in Florida. Even though Florida FHA guidelines don't stipulate a minimum credit score, most lenders implement their own requirements, typically expecting the middle FICO score to be at least 580 for standard approval.

However, you could still qualify for an FHA loan if your score falls in the 500 to 579 range. In this lower score bracket, borrowers must make a larger down payment, specifically 10% of the home's purchase price. This higher down payment safeguards lenders, balancing the risk of lower credit scores.

FHA Employment History Requirements

Contrary to what many might assume, the FHA's requirements for employment history are not super strict in Florida. A common misconception is that starting a new job, like a marketing position last month, might disqualify you from FHA loan eligibility. However, this isn't necessarily the case.

The key factor for FHA approval is consistency in your line of work. If you've been employed in the same field for at least two years, with no significant gaps in your employment history, you're generally in a good position for FHA financing.

However, it's important to note that not all Florida job changes are viewed equally. Transitioning from one career field to another, such as moving from a waitress role to a secretary position, wouldn't typically be considered the same line of work. But there are exceptions.

For example, if you were in college and have now secured a job in your field of study, this job change can be considered a continuation of your professional path, aligning with FHA requirements. This flexibility in considering your employment history is one of the aspects that makes FHA loans a viable option for many borrowers.

FHA Down Payment Requirements

The down payment requirement is one of the most critical aspects of securing an FHA loan. To qualify for an FHA loan, you must have the financial capacity to put down at least 3.5% of the loan amount. For instance, a $200,000 loan translates to a down payment of $7,000.

This requirement is notably lower than conventional loans, which generally demand a down payment ranging from 5% to 10%. In the case of a $200,000 conventional loan, this could mean a down payment of $10,000 or more, plus additional closing costs.

The FHA loan program also offers flexibility regarding the source of your down payment. It can be a gift from a relative, or you can even borrow it from your 401k, offering a range of options to gather the necessary funds. However, it's important to note that the down payment cannot come directly from the seller.

Despite this, FHA loans have another advantage - they allow the seller to contribute up to 6% of the loan amount towards closing costs. Considering that closing costs typically don't exceed 5% of the loan amount, this provision can significantly ease the financial burden on the buyer.

FHA Loan Amount Requirements

In 2024, the FHA loan limits in Florida have been set to accommodate a wide range of homebuyers. The loan limit for most counties for a single-unit property is $498,257.

This cap is designed to accommodate the financial needs of most borrowers seeking FHA financing for their home purchases.

Prospective borrowers must be aware of these limits as they plan their home-buying journey, ensuring their desired property falls within the FHA's financing capabilities.

However, it's noteworthy that 11 counties in Florida have slightly higher limits, as seen in the chart below. Many of these counties are home to Florida's largest cities and most valuable properties, thus having higher loan limits than the standard amount.

This adjustment reflects the higher property values in these regions, allowing borrowers in these areas to access larger loan amounts under the FHA program.

When considering an FHA loan in Florida, you must check the specific loan limits for the area where you plan to purchase your property.

FHA Term Requirements

One key decision regarding FHA loans in Florida is choosing the term of your loan. The two primary options available are 15-year and 30-year terms. Each choice has its own set of benefits and implications for borrowers.

Opting for a 15-year term typically means higher monthly payments, but you'll pay off your mortgage in half the time compared to a 30-year term. This shorter term also usually comes with lower interest rates and results in less interest paid over the life of the loan.

On the other hand, a 30-year term offers lower monthly payments, making it a more manageable option for many buyers, especially first-time homeowners. However, the trade-off is that you'll pay more in interest over the life of the loan.

The choice between a 15-year and a 30-year term largely depends on your financial situation and long-term goals. A 15-year term can be a great choice if you're looking to build equity quickly and save on interest.

Conversely, a 30-year term might be more suitable if you prefer lower monthly payments and greater flexibility in your budget.

FHA Debt-to-Income Ratio Requirements

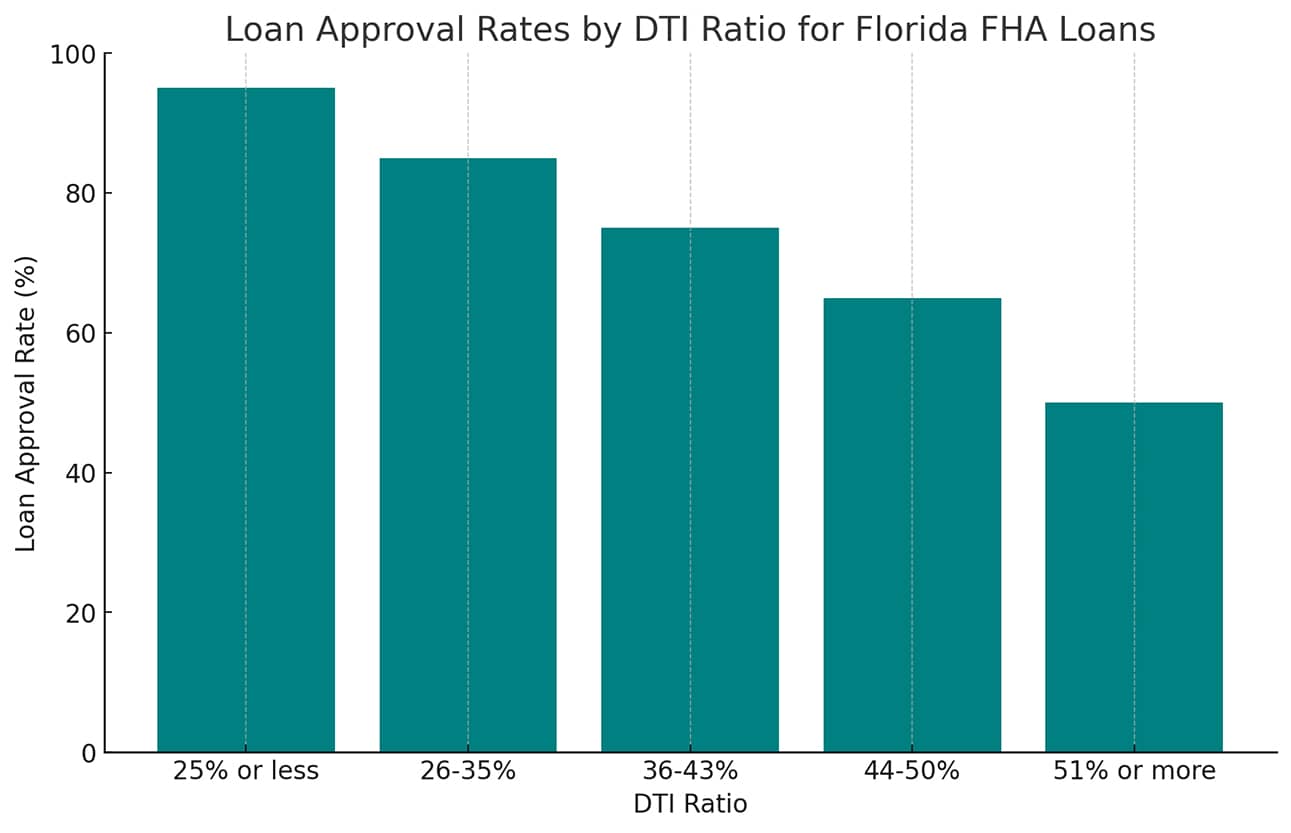

An essential aspect of qualifying for an FHA loan in Florida is the debt-to-income (DTI) ratio. This ratio is a key indicator of your ability to manage monthly payments and repay debts. The FHA guidelines are somewhat flexible, allowing for a DTI ratio of up to 57% in certain circumstances.

To calculate your DTI ratio, divide your total monthly debt payments by your gross monthly income. This calculation includes all debt obligations such as credit card payments, car loans, student loans, and your anticipated mortgage payment.

For instance, if your monthly debt payments total $1,500 and your gross monthly income is $4,000, your DTI ratio would be 37.5%.

The 57% threshold offers a higher limit than many conventional loan programs, making FHA loans more accessible to individuals with higher debt levels.

However, it's important to remember that while a higher DTI ratio can be accepted, it's always best to have a lower ratio to increase the likelihood of loan approval and to ensure financial comfort in managing your mortgage payments.

Housing Ratio Requirements

An important criterion in the FHA loan process is the housing ratio, which is closely scrutinized to ensure borrowers are not overextending their finances.

The FHA stipulates a 31% or less housing ratio for loan eligibility in Florida. This ratio measures how much of a borrower's pretax income is for housing-related expenses.

To calculate the housing ratio, you divide the total of all property-related expenses by your gross (pretax) income. These expenses typically include your monthly mortgage payment, property taxes, homeowner's insurance, and any homeowner association fees.

For example, if your combined monthly housing expenses amount to $1,200 and your monthly pretax income is $3,870, your housing ratio would be approximately 31%.

This 31% cap is designed to ensure that homeowners are not allocating an excessive portion of their income toward housing costs, which could lead to financial strain.

By adhering to this guideline, FHA loans help maintain a balance, enabling homeowners to afford their mortgage while managing other financial responsibilities.

Mortgage Insurance Requirements

Mortgage insurance is a critical component of FHA loans, and significant developments have occurred in this area as of 2024.

The U.S. Department of Housing and Urban Development (HUD) announced that the Federal Housing Administration (FHA) will reduce its annual mortgage insurance premium (MIP) for new homebuyers.

Effective March 20th, the MIP rate has been lowered by 0.30, dropping from 0.85% to 0.55% for borrowers financing more than 95% of their home value.

The FHA mortgage insurance premium is an additional monthly fee paid by homeowners with FHA-insured loans, over and above their monthly principal and interest payments.

This reduction in the MIP rate represents a significant saving for new homeowners. The change is expected to save homebuyers with new FHA-insured mortgages about $800 per year.

This adjustment in mortgage insurance costs will make housing more affordable for many, and it has broader implications. It is projected to benefit an estimated 850,000 new homebuyers in 2024 alone.

Reducing the MIP rate is a move toward making homeownership more accessible and reducing the overall financial burden on new homeowners in the Florida housing market.

Bottom Line

Navigating the intricate landscape of FHA loans in Florida requires a thorough understanding of various requirements and guidelines.

This article has provided a detailed overview of the key FHA loan requirements for 2024, addressing critical aspects such as credit scores, employment history, down payment, loan amounts, loan terms, debt-to-income ratios, housing ratios, and mortgage insurance.

Each of these components plays a significant role in determining your eligibility and the overall affordability of an FHA loan.

Whether you are a first-time home buyer or looking to refinance, understanding these requirements is crucial in making informed decisions.

With options like lower down payments, flexible employment requirements, and reduced mortgage insurance rates, FHA loans are an attractive choice for many Floridians.

As you embark on your journey towards home-ownership, remember these guidelines to navigate the process confidently and easily.

Remember, every aspect, from your credit score to the loan term you choose, can significantly impact your home-buying experience and long-term financial health.

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by